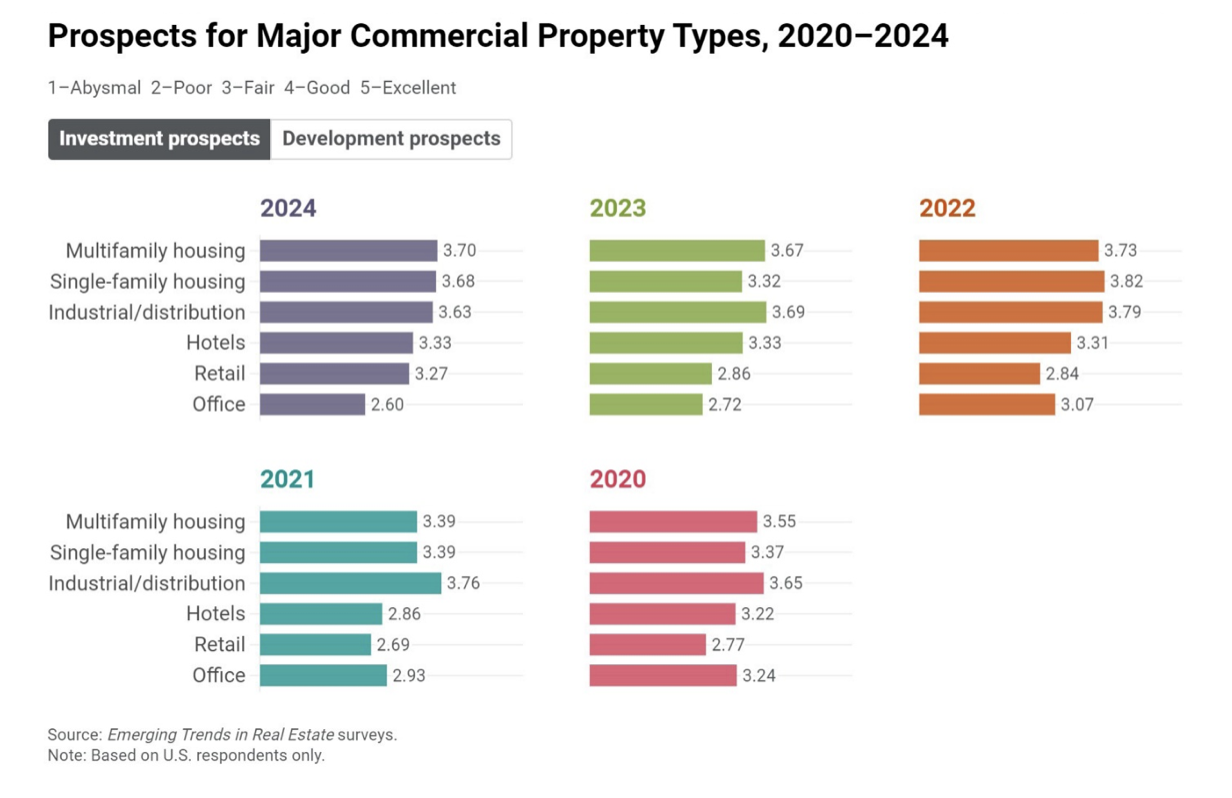

The latest Emerging Trends in Real Estate report published by Price Waterhouse Coopers in November 2023 states that they are anticipating that apartments in the US have “long-term demand drivers that should enable it to maintain steady market performance.”1

Because of this, PWC cites the industry as a standout among current real estate investment classes, where challenges have been confronted by all segments in the past year. The research lists the “the danger of an impending economic crisis, skyrocketing loan rates, and growing costs as recent challenges."

PWC notes that "the tone in multi-family housing is much less negative than other segments" despite these general economic challenges.

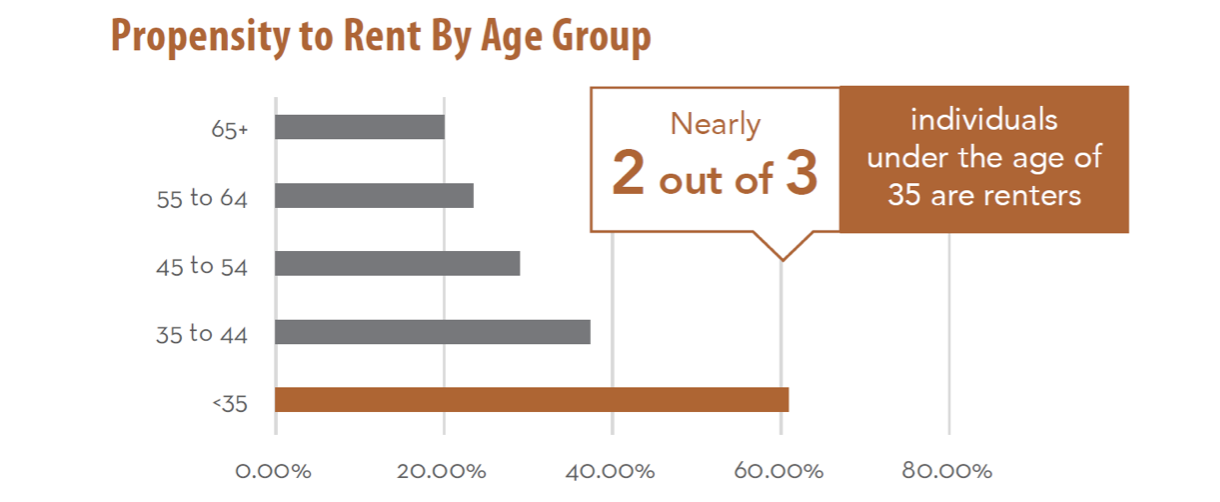

Millennials Will Drive Demand for Rental Properties

Per government census figures, the next wave of demand will be driven by millennials (generally those born between 1980 and 2000).2

Contributing factors include:

All time high student debt making it more difficult to buy versus rent

Ability to work remotely which increases housing demand in lower cost areas

Delays in major life decisions (marriage and starting a family)

Desire for a more flexible lifestyle

Higher interest costs and tighter credit standards favoring rent versus buy

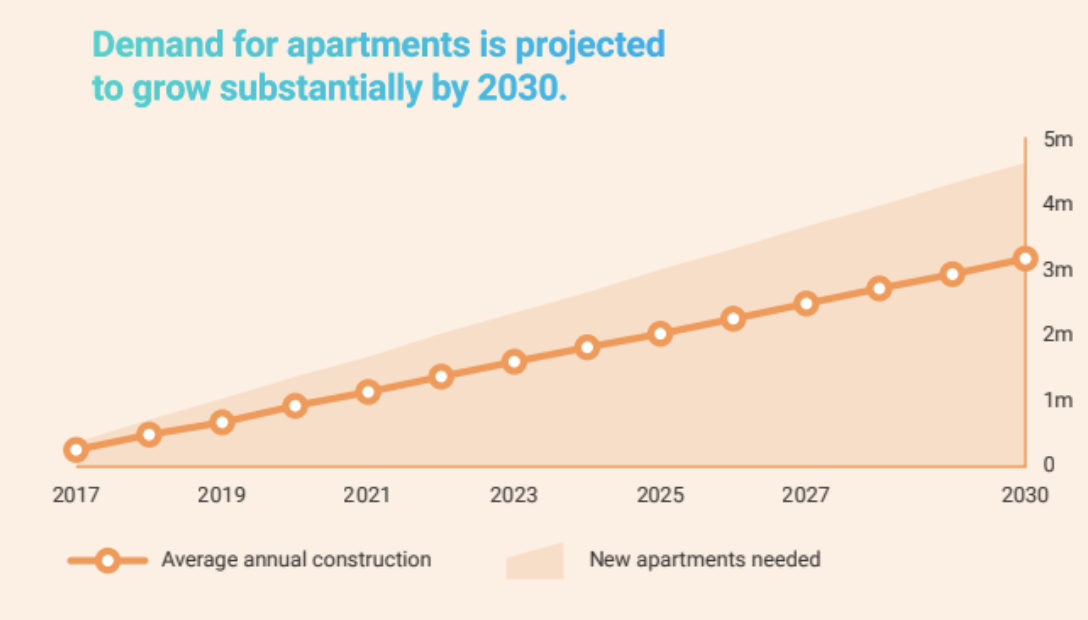

There has been an increase in the supply of multi-family properties recently, with tens of thousands more apartment units added nationwide. Instead of being an underlying trend, PWC asserts that this "recent bump in supply will one day be seen as a hiccup."

According to the research on longer term trends, to fulfill the anticipated rise in housing demand, at least 4.6 million more units must be built by 2030; else, the already severe affordability issues could worsen.3

Sustained Demand for Both Smaller and Luxury Units

Due to growing mortgage rates and home prices, demand for luxury apartments has been stable over the past few years, and these properties are probably going to stay strong. Class A rental vacancy rates increased by 30 basis points between the end of 2022 and the middle of 2023, while Class B and Class C rentals saw a surge of 40 to 80 basis points over that same period.

The desire for luxury housing among some segments, such millennial renters, is being supported by high obstacles to owning, and this trend is expected to continue into the upcoming year.4

Apartment Oversupply Projected to be Short-Lived

Experts predict that the market's excess supply will pass quickly since census data indicates that while city populations are still increasing, housing supply is not keeping up with demand. Most of the new supply is concentrated in a small number of major cities, which may short-term depress rents and reduce returns in the short term, but overall population trends indicate demand will remain high.

Furthermore, multifamily home construction has probably already peaked. The trailing fourth quarter total for new construction was 351,500 after 91,400 units were delivered in Q2. Recent lower quarters indicate a decline in new building deliveries in 2024.5

Investment Planning for 2024

Despite economic and political headwinds, recent data suggests that overall demand and anticipated returns from select apartment investments remains favorable relative to other investment classes. When making any investments, we recommend that investors should perform adequate due diligence prior to committing funds and utilize resources and inputs from knowledgeable professionals in the industry.

Please contact FGG1031 | First Guardian Group today if you have any questions or would like more information.

1 https://www.pwc.com/us/en/industries/financial-services/images/pwc-2024-etre-us-final.pdf

2 https://www.census.gov/housing/hvs/data/histtabs.html

4 https://commercialobserver.com/2023/08/luxury-apartment-demand-steady-amid-multifamily-pressures/

Your Comments :