Investment property owners considering a 1031 exchange frequently ask our team at First Guardian Group about the rules of “debt replacement” they must follow. It is not surprising we receive these questions because while IRS regulations require that the value of the debt on the relinquished property be replaced on the new property, there are no clear guidelines on how that debt should be replaced.

The American Bar Association provides a nice summary explanation of the requirement:

How are mortgages on the relinquished property treated?

“A mortgage or deed of trust on the Relinquished Property can be paid off with exchange proceeds. The portion of the proceeds used to pay the mortgage or deed of trust are deemed Realized Proceeds, however and are included in the Exchange Value, so the mortgage must either be replaced with a new mortgage or cash from outside the exchange in purchasing of the Replacement Property.”

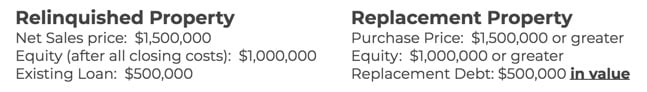

It is important to note that the replacement of debt does not necessarily mean a 1031 exchanger has to take out a new mortgage in the same amount, but rather, it is the value of the relinquished debt that needs to be replaced. Here is an example:

The debt replacement value of $500,00 can be funded by using one or a combination of any of the following:

- Cash (from outside the exchange)

- Traditional Financing (another mortgage)

- Seller-Financing (the seller uses a Carryback Note to finance the property)

- Private Money Loan

Avoid Boot

Boot is a term used to describe a recognized gain (taxable event) in a 1031 exchange and it can be generated in several ways. Most 1031 exchange investors think of boot as what happens when failing to reinvest all the equity from the relinquished property, but boot can occur by making a mistake on debt replacement as well. Again, as described by the American Bar Association, boot can occur by:

“Not replacing debt paid off on the Relinquished Property. Because the portion of proceeds used to pay debt is deemed realized, the Taxpayer must replace it either with new debt or cash from outside the exchange in purchase of the Replacement Property in order to avoid recognizing it.”

A common problem that we encounter with especially retired investors is that, while they may have accumulated substantial net worth, they may no longer have sufficient income to qualify for a loan to purchase a traditional real estate replacement property in order to complete a 1031 exchange.

Delaware Statutory Trust (DST) options may provide a solution for this problem since many DSTs already have a loan in place. Since the loan has been granted to the DST sponsor who is the sole borrower for the DST, the investor does not need to qualify for the loan – but can take advantage of it for purposes of meeting the 1031 exchange debt requirement and also taking advantage of applicable interest deductions on their tax returns.

If you have any additional questions or if we can help with your exchange, do not hesitate to contact us at info@firstguardiangroup.com

Your Comments :