In a past blog post, we summarized efforts by the California Franchise Tax Board (FTB) to begin imposing penalties against 1031 Exchange Qualified Intermediaries who actively assist clients with deferring taxes through Deferred Sales Trusts or Monetized Installment Sales.(1)(2)

In this blog, we will highlight several important takeaways from that blog plus update our readers on efforts by the IRS to further crack-down on the use of these “too good to be true” schemes to delay tax consequences.

Background

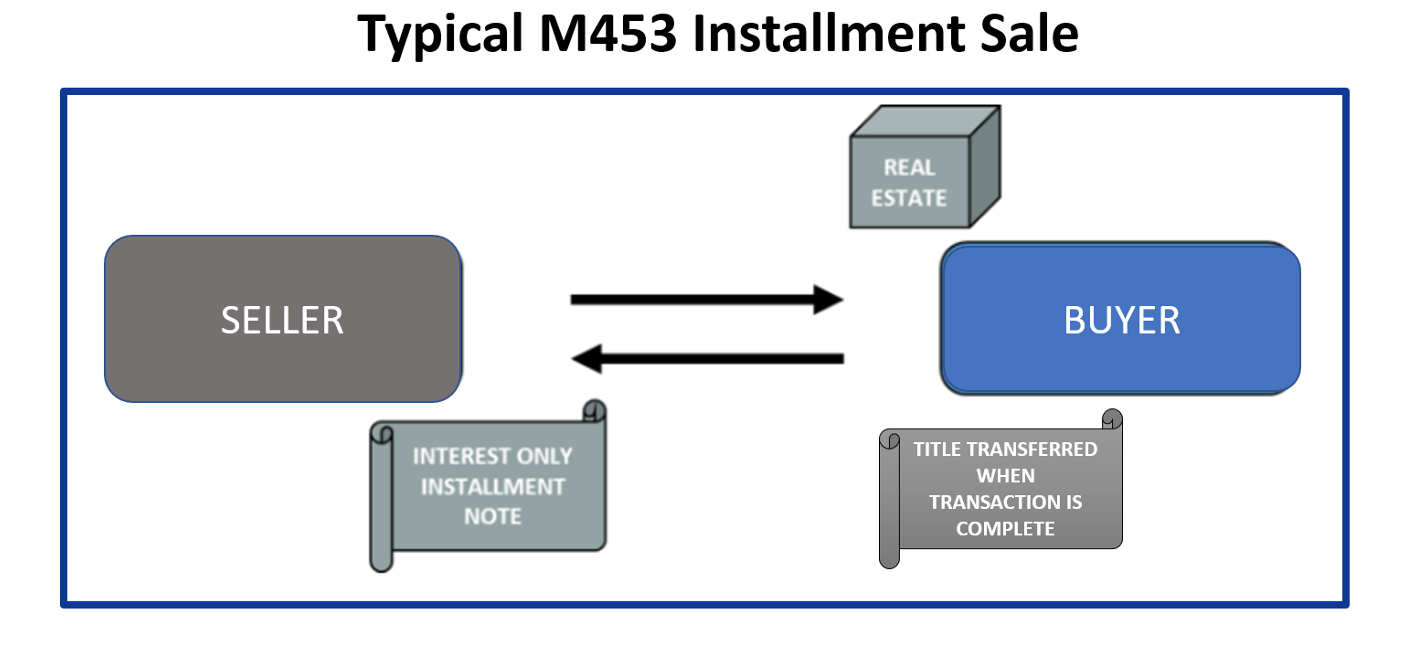

An installment sale is a type of sale where a buyer takes possession of the property and agrees to pay the seller over time, often making interest only payments for some period followed by a balloon payment to the seller which includes any remaining owed principal. IRS tax code M453 states that no capital gains taxes are owed by the seller in an installment sale until such time that they begin collecting principal funds from their sold property. While sellers would be obligated to pay income tax on any interest income that they receive in an installment sale, they could defer the payment of capital gains taxes into the future until they receive the principal funds from their sale.

If the installment sale payments included both interest and a partial paydown of the principal balance of the note, capital gains would be owed during the year that any of principal loan balance was received by the seller/note holder.

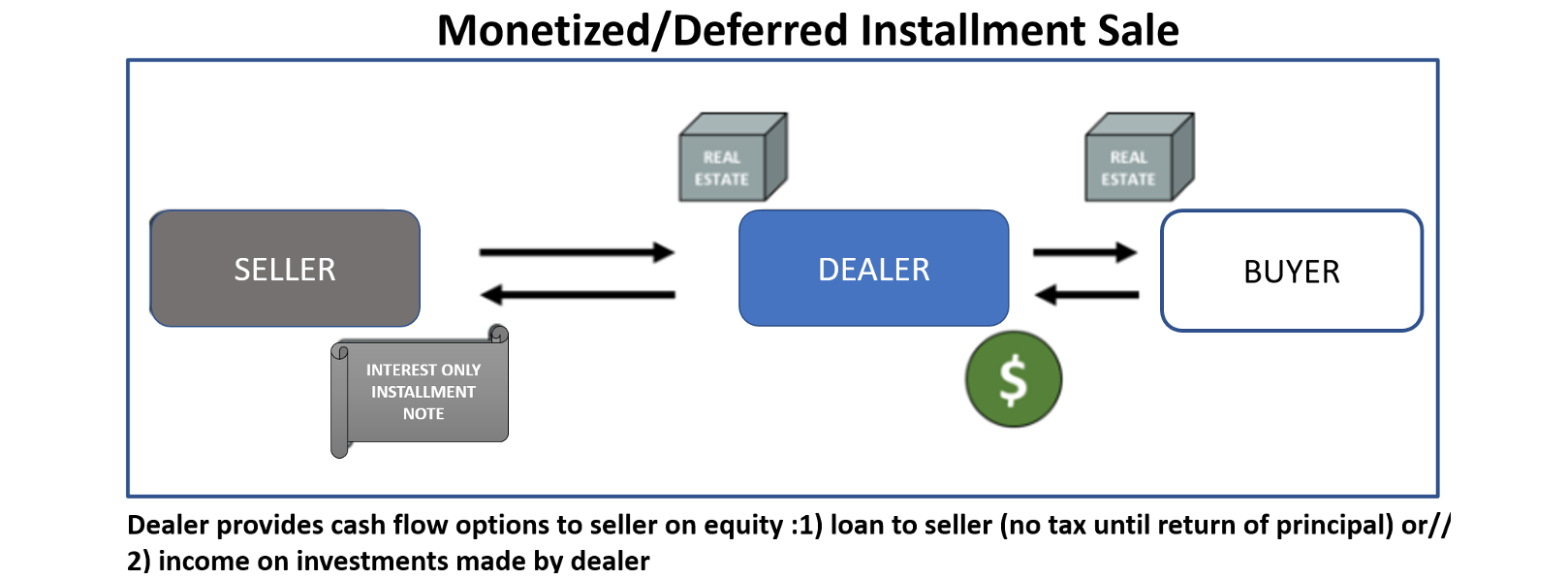

In a Deferred Sales Trust3 or Monetized Installment Sale, an intermediary is involved who accepts purchase proceeds from a buyer and then provides funds to seller in either the form of a loan or though a stream of payments from investments that are made by the intermediary. These quasi-installment sales are structured to yield a more immediate use of sale proceeds to the seller than what tax authorities believe`` is intended by tax laws. “

Contrary to what some promoters may tell their customers, these types of transactions are NOT supported by the current tax code. Promoters may cite private letter rulings or refer clients to tax advisors or attorneys who will support these schemes – but those justifications should not be solely relied upon without further investor scrutiny and inputs from their qualified personal tax advisors.

One the nation’s largest Qualified Intermediary firms, IPX1031 quoted CA FTB officials as stating that “they view these transactions as “clearly improper” and “blatantly unsupported by the law.”

IRS Labels Monetized Installment Sales as Part of Its Annual Dirty Dozen

In 2023, the IRS joined efforts by state tax authorities to target monetized installment sales and included them as one their annual “Dirty Dozen” of tax avoidance schemes4. The cited IRS publication states:

These are examples of potentially abusive arrangements that taxpayers should avoid, many of which are now advertised online. The IRS recommends that taxpayers considering these types of arrangements carefully, review the legal requirements underlying them, and consult with competent, independent, qualified advisors before engaging or claiming any purported tax benefit.

Where appropriate, the IRS may assert accuracy-related penalties ranging from 20% to 40% of an underpayment of tax, or a civil fraud penalty of 75% of any underpayment of tax related to transactions like those listed here.

However, this is not an exclusive list of transactions the IRS is scrutinizing, and taxpayers and practitioners should always be wary of participating in transactions that seem "too good to be true."

IRS Proposes That Taxpayers Must Identify Monetized Sales and Similar Transactions

Later in 2023, the IRS took further steps by proposing that that taxpayers who utilize these types of tax avoidance schemes must declare on Form 8886 and may then be required to provide additional information. 5

Further actions are expected in 2024.

Takeaways

When considering tax deferral strategies, investors must be very cautious in accepting the claims of promotors who offer “too good to be true” tax avoidance schemes. There are growing efforts by state and federal tax authorities to limit and likely prohibit the abusive tax schemes described in this blog. While it may be tempting to receive a large portion of sales proceeds without paying taxes, the consequences can be severe.

We agree with the vast majority of tax advisors that investors are better served by following both the letter and the intent of the current tax code. Tax deferral strategies allowed in our current tax code including the 1031 exchange along with investments in properly structured Delaware Statutory Trust (DST) 1031 replacement properties minimize the risks of future fines and penalties.

For more information on Delaware Statutory Trust options and approved 1031 Exchange tax deferral strategies, please contact FGG1031/First Guardian Group at 866 398-1031 or info@FirstGuardianGroup.com.

1 https://blog.fgg1031.com/blog/california-tax-board-disallows-deferred-sales-trusts

2 https://www.ftb.ca.gov/tax-pros/law/ftb-notices/2019-05.pdf

3 Deferred Sales Trust is sometimes referred to as “DST” – however this “DST” is not in any way related to the Delaware Statutory Trust which is fully supported in the tax code.

5 https://public-inspection.federalregister.gov/2023-16650.pdf

Your Comments :