Due to announcements from the current administration regarding a possible reduction in tax deferral benefits via a 1031 exchange, many of our clients have asked us to comment on other tax deferral strategies that may be available to them.

In this blog post, we will discuss real estate tax deferral via a 721 exchange or UPREIT. Similar to the 1031 exchange, a real estate investor may be able to defer tax obligations on the sale of an investment property through acquiring shares in a special form of a Real Estate Investment Trust (REIT) called an UPREIT.

In a previous blog we discussed that REITs are companies that own income-producing real estate assets or financing instruments. REITs generate income which is then paid out to shareholders in the form of a dividend. To avoid double taxation, which is common with a corporation structure, REITs must pay out at least 90 percent of their taxable income to shareholders.

Which properties qualify for a 721 exchange?

REITs tend to focus on investing in specific institutional asset classes e.g., apartments, self-storage, necessity retail and typically only acquire additional properties that are like those they already own. For example, an apartment REIT will not have an interest in acquiring a single-family rental property or other non-apartment property types.

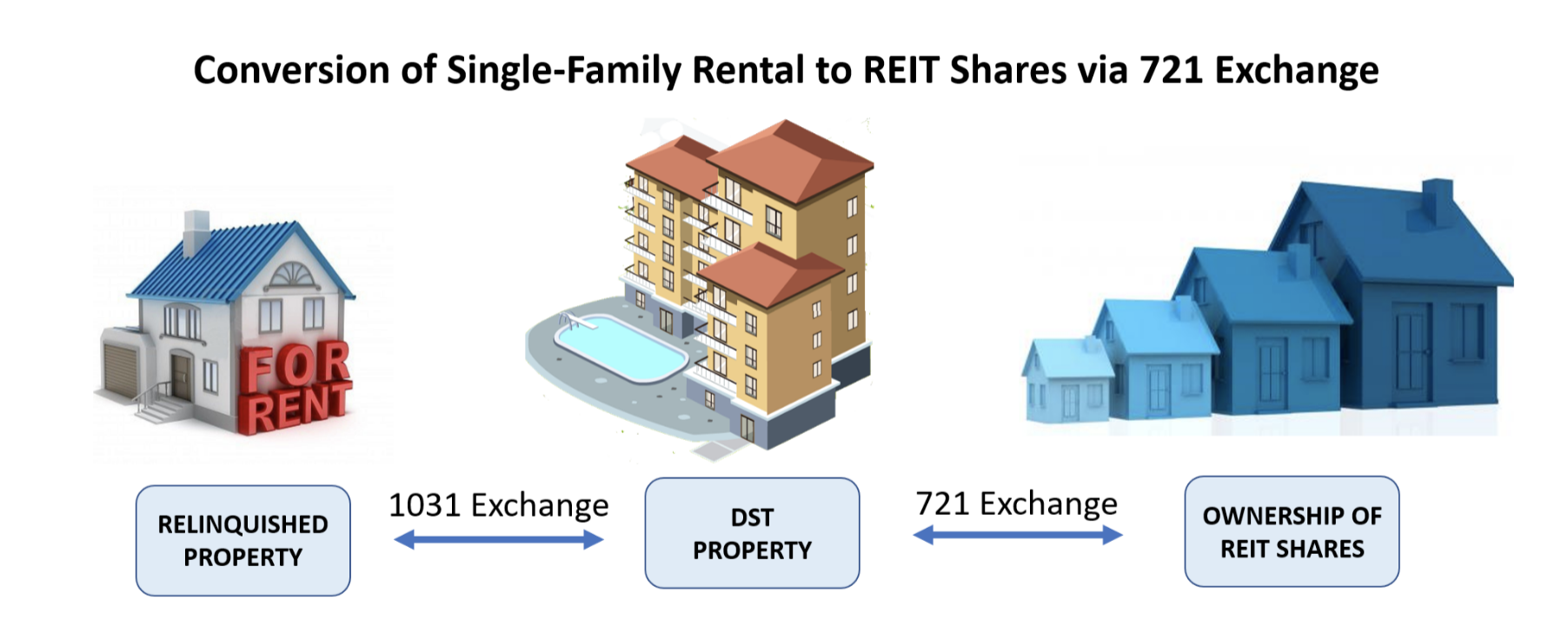

Therefore, if an investor is seeking to defer taxes from the sale of their rental property via a 721 exchange, they must first exchange the equity of their property into a property type that can be acquired by a REIT. This can be accomplished by initially completing a 1031 exchange into a DST of a sponsor who is offering a 721-exchange option at the time the DST is sold in the future.

Through utilizing a 1031 exchange, an individual investor can exchange a property that does not meet a REIT's criteria e.g., a single-family rental can be exchanged via a 1031 exchange for a DST interest that can then be acquired by the REIT in a future tax-deferred 721 exchange.

When would a 721 exchange be preferable to a 1031 exchange?

While there are currently discussions in Washington over possible changes to future 1031 exchange benefits, at least for now, the 721 exchange is off the radar screen. Presuming that modifications are not made, a conversion of DST equity to REIT shares via a 721 exchange when the DST is sold may provide an attractive tax deferral option relative to doing a future 1031 exchange that may have limits on the degree of permitted tax deferral at that time.

Converting DST interests into REIT shares may have other benefits as well:

- We have seen examples where the dividends of the REIT may be higher than the distributions of available DSTs or many other “like-kind” options.

- REIT shares may provide greater liquidity to investors especially if the REIT is publicly traded or offers periodic redemption rights to its investors,

- Since REITs are ongoing companies, investors can keep their equity invested and generating income for a long term and not be required to reinvest every few years when their DST properties are sold.

- While REITs tend to focus on a single asset class, they typically own many properties in multiple locations that can provide added diversification and stability of income relative to other real estate investments.

- Like DSTs, REITs also can provide a degree of tax shelter on their dividends.

- Unlike DSTs, REIT share are easily divisible.

- REIT investments can also be passed along to remaining spouses and heirs upon passing of a principal investor on a “stepped-up” basis which may eliminate capital gains tax burdens.

Potential disadvantages of owning REIT shares:

- Once an investor completes a 721 exchange, they will no longer be able to complete a 1031 exchange into new investments. A 721-exchange is a one-time tax deferral strategy and upon sale of the REIT shares, taxes will be owed (unless a step-up in basis occurred through the passing of a principal investor).

- If the REITs are tradable or become tradable in public markets, they will, like all publicly traded stocks, be subject to market volatility and may quickly rise or fall in value.

- Investors in a REIT are passive and have no control over the ongoing operations of the REIT (like a DST or mutual fund).

- Shares in a private REIT may have limited liquidity options that could tie up invested funds for a lengthy period.

- Private REITs may convert to publicly traded REITs and the values of the shares will be then subject to the scrutiny of new investors who value the shares at a lesser value than when the REIT was private. Shares can also go higher in value in a private to public conversion – so each situation should be independently analyzed.

Summary

A growing number of DST sponsors are offering 721 exchange options to their investors at time of sale. This trend was occurring even prior to recent discussions over possible changes in 1031 exchange benefits and is now accelerating due to increasing interest from investors seeking alternative tax deferral options.

For more information on 721 exchange options and obtaining a list of current DSTs that offer a 721 option, please contact us at 408-392-8822 or info@FirstGuardianGroup.com.

Help Save 1031 Exchanges.

Have you downloaded our latest Ebook?

References:

Your Comments :