Many property investors are familiar with the 1031 exchange, a tax provision that allows you to defer capital gains taxes and depreciation recapture on a business property sale by replacing it with a like-kind replacement property. However, you may not be aware of the potential opportunity to take advantage of a 1033 exchange – a lesser-known option that allows you to defer capital gains taxes on properties that have undergone an “involuntary conversion.”

Following, you’ll find an overview of 1033 exchange requirements and some important differences between the two types of exchanges.

1033 Exchange Qualification Requirements

To qualify for a 1033 exchange, a property must have been condemned, destroyed in a natural disaster, or seized or lost through eminent domain. When these situations occur, the property isn’t necessarily “sold.” However, the property owner will typically receive cash compensation either from their insurance company, or in the case of eminent domain, from the government.

If the compensation received is greater than the property’s cost basis, this may result in a taxable gain. However, you can defer these taxes by engaging in a 1033 exchange, a process that requires you to invest the proceeds into a qualified replacement property.

To qualify for a 1033 exchange, the following conditions must be met:

- The original property (also known as the “converted property”) must have been condemned, seized, or destroyed.

- The replacement property’s title and the converted property’s title must both indicate the same individual or entity ownership.

- The cost of the replacement property must equal or exceed the net payment received.

- The debt on the replacement property must equal or exceed the debt on the converted property.

- The replacement property must have a “similar or related” use to the converted property, meaning that both properties must be physically similar and used for a similar purpose. For example, an apartment complex must be replaced with another apartment complex, rather than an industrial building, hotel, or vacant land.

- The replacement property must be purchased within the two-year replacement period, which begins at the end of the calendar year in which compensation was first received. However, this period extends to three years if the property has been condemned.

1031 vs 1033 Exchange: A Simple Comparison

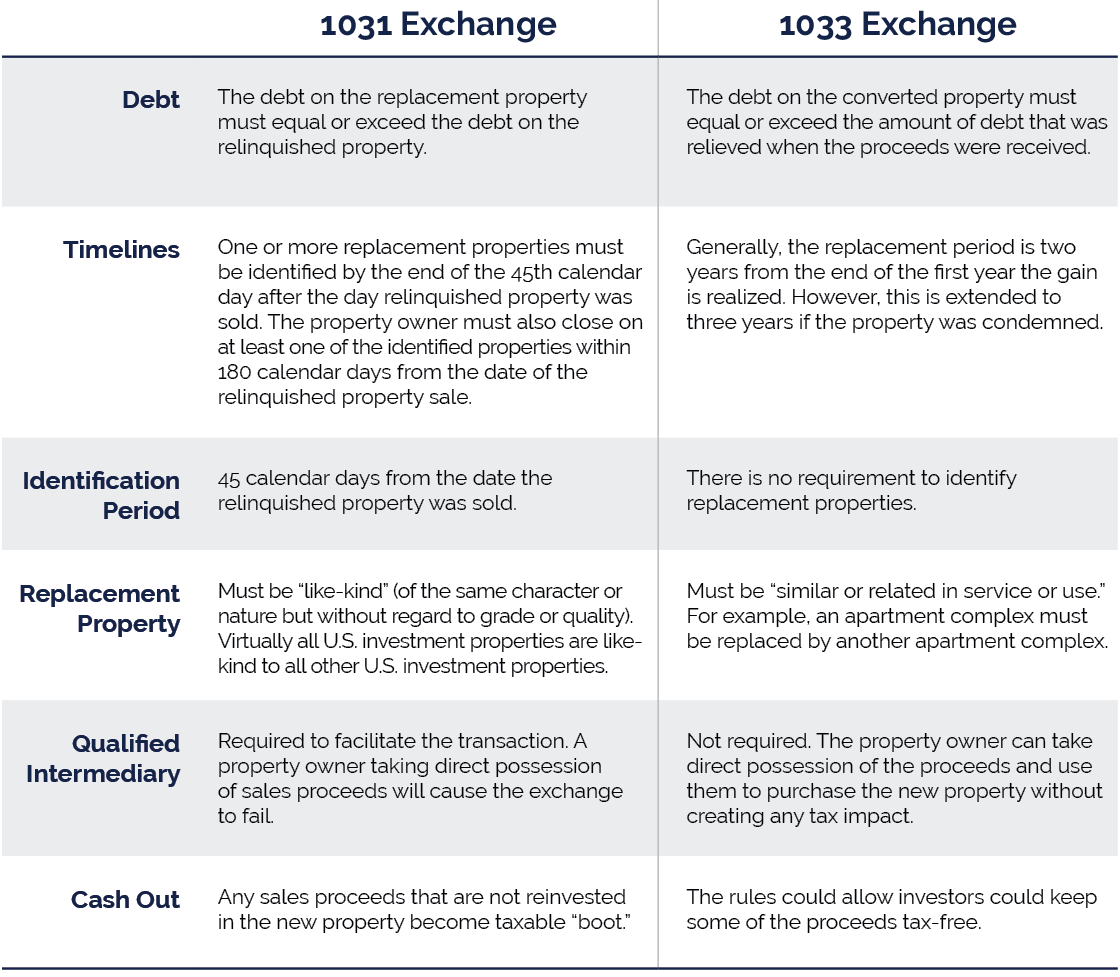

Understanding the differences between a 1031 exchange and a 1033 exchange can help you decide which option may be best for you. Here are a few of the primary factors to consider.

Explore Your Options

While a 1031 exchange can be used to replace any type of investment property, a 1033 exchange only applies to properties that have been condemned, lost or seized through eminent domain, or destroyed in a natural disaster. To learn more about each of these options and how they may apply to you, contact us today to schedule a consultation with a member of our team.

Your Comments :