One of the most powerful tools for preserving and building wealth across generations is the tax benefit called the step-up in basis. This important provision of the tax code had its origins in the Revenue Act of 1921 and has been integral in estate planning strategies in its varying forms over the past 100+ years. Since step-up in basis has been in the news recently as part of various tax modification proposals1, we have received a growing number of questions that we would like to address in this blog about how it works – especially when combined with a 1031 exchange tax deferral.

What is a Step-Up in Basis?

The basis of an investment is generally defined as the value of the asset at time of acquisition, less any allowed adjustments in basis that may occur during the holding period of the asset. For real estate investment properties, the tax code allows investors to adjust the basis of their investment properties both up and down as follows:

- Basis is reduced by applying allowed depreciation deductions to the building portion of their property (not the land) and

- Basis can be increased by investing in permitted capital improvements which significantly increase the property’s value

A step-up in basis occurs upon the death of an owner when the asset is passed on to heirs or a surviving spouse. The value of the asset is reset to current fair market value at time of passing.

For example, let’s assume mom had purchased a property for $100,000 twenty years ago and at the time of her passing her daughter inherited the property at a current market value of $400,000. If the daughter decided to sell the property shortly thereafter for $400,000, the daughter would not incur any capital gains tax liabilities since she would be deemed to have acquired the property for its current market value of $400,000.

If the daughter instead decides to hold the property rather than sell it, she would be responsible for eventually paying capital gains taxes only on the appreciated value of the property above $400,000 at the time of a future sale.

While a step-up in basis can apply to many financial assets including stocks and bonds, we will focus the remainder of our discussion on how it applies to real estate.

Community Property Versus Common Law Property

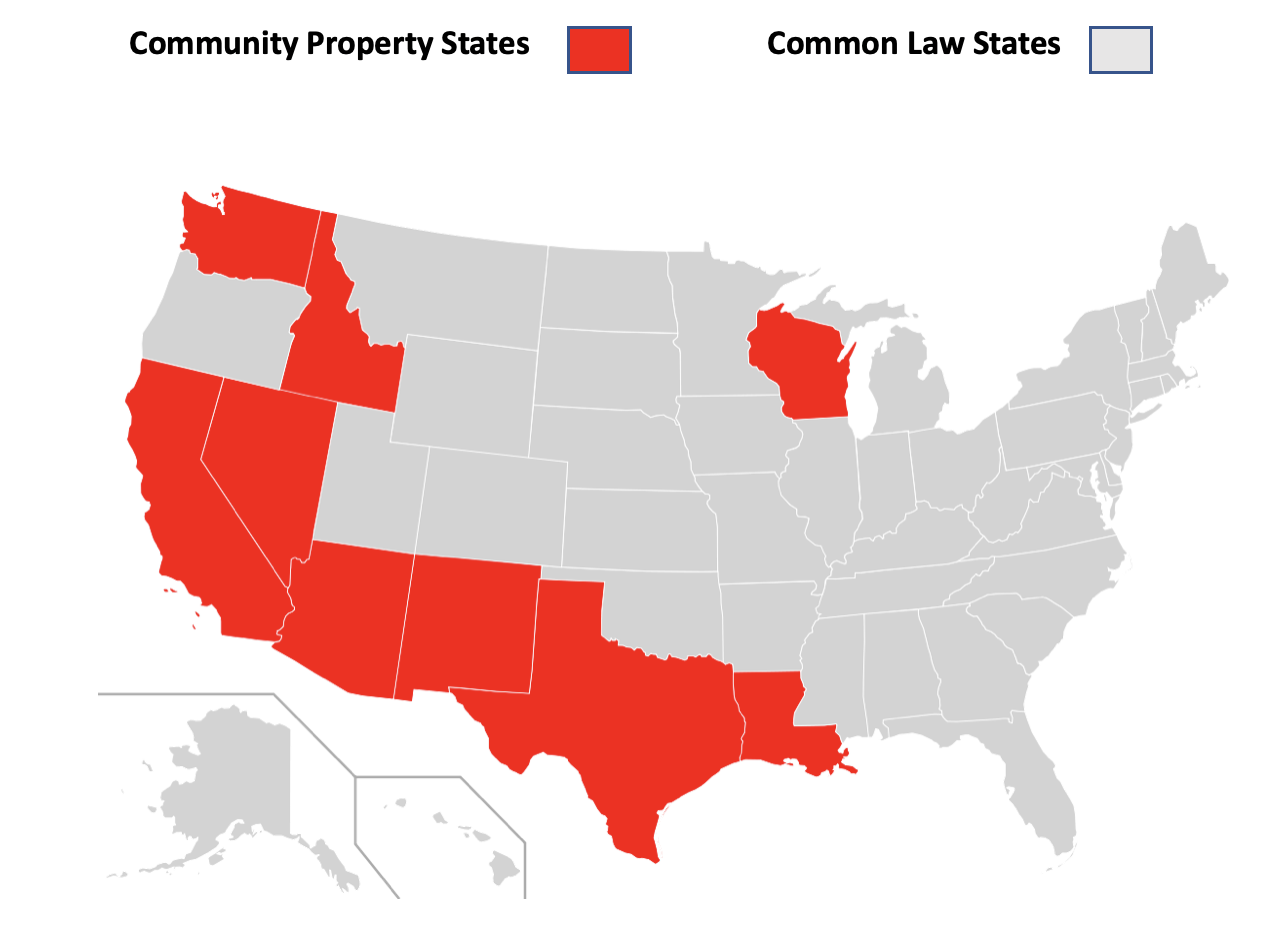

Step-up in basis tax rules vary depending on the state where the married owners reside.

Community Property States

Nine states including Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin utilize a community property doctrine which recognizes that properties acquired by married spouses are jointly owned by the couple and allow their residents to benefit from a double step-up in basis rule that raises the cost basis to the full current Fair Market Value of the property in the event that one spouse passes. This results in a full step-up for both the deceased and surviving spouse’s share of the property.

Common Law Property States

Investors living in common law property states are generally only allowed up to a 50% step-up in basis to apply to only the surviving spouse’s share of the property. These states rely on a common law doctrine which recognizes that each spouse during marriage can acquire and own assets in their own name that are not automatically jointly owned by both spouses. For example, if during the ownership of a property by a husband and wife, the property increased in value from $200,000 to $400,000, the surviving spouse would receive a step-up in basis from $200,000 to $300,000 – and not the full current market value of $400,000.

Five common-law states including Alaska, Florida, Kentucky, South Dakota, and Tennessee have passed statutes that allow a married couple to convert common-law property into community property, thus permitting couples to obtain a full step-up in basis upon the death of the first spouse.

Residents in other common law states who wish to gain greater step-in basis benefits should explore options for creating a community property trust.2

The Bottom Line

Options to obtain a full step-up in basis can be complicated – especially for investors who reside in non-community property states.

Understanding the tax rules such as the step-up in basis strategy can help you and your family preserve the value of inherited assets and minimize tax liabilities when you are ready to sell.

The step-up basis can be most beneficial when combined with a 1031 exchange tax deferral strategy also known as a “Swap Until You Drop” strategy. Combining the step-up in basis with a 1031 strategy can not only provide investors with an ongoing deferral of capital gains tax liabilities – but can also result in the avoidance of capital gains taxes when those assets are passed on to heirs or surviving spouses.

To learn more and obtain referrals to experienced tax advisors, please contact us to schedule a consultation with a member of our team.

1 https://taxfoundation.org/biden-estate-tax-unrealized-capital-gains-at-death/

Your Comments :