One of the most attractive aspects of investing in rental properties is to achieve higher after-tax income relative to other investment options. Experienced real estate investors understand that a 5% yield from a rental property will produce higher after-tax income than a 5% yield from stocks or bonds since taxes on real estate income can be reduced by taking advantage of unique deductions that are not available to other investments.

One of the most significant real estate deductions is to reduce taxable income by subtracting allowed depreciation. The tax code permits investors to write-off a portion of the value of their building each year from the income produced. The building portion of residential properties can generally be written off or depreciated over 27.5 years and commercial buildings can be depreciated over 39 years.

Straight-line Versus Accelerated Depreciation

While most of our clients and their tax advisors utilize traditional 27.5- or 39-year straight-line depreciation deductions, a growing number of our more experienced investors are exploring and implementing ways of further accelerating depreciation deductions.

As an alternative to straight-line depreciation deductions, the tax code permits investors to potentially increase allowed depreciation by segregating the components of their building into categories that have a shorter useful life than what is allowed under straight-line depreciation.

What is Cost Segregation?

Through analyzing the construction costs of a building via a Cost Segregation Study, certain components of the building such as personal property, carpeting, electrical, plumbing, or mechanical having a shorter useful life can be either be fully expensed in year one or depreciated over 5, 7, or 15 years. The potential tax savings can result in a significant increase in annual after-tax net cash flow.

The Tax Cuts and Jobs Act of 2017 further improved potential depreciation deductions by allowing investors to fully expense the cost of certain capital investments that have a useful life of less than 20 years. Examples include machinery, computers, appliances, and furniture, among others.

Who Performs Cost Segregation?

Cost segregation studies have become more common in recent years and there are a growing number of service providers who can perform the needed work. While there are some Do It Yourself options available, most investors would benefit from having a qualified third party complete the study and also take responsibility to represent the investor if questions arise from tax authorities.

The investor should also plan to work with a knowledgeable real estate tax advisor who has experience completing tax filings for clients who take advantage of accelerated depreciation.

The investor should be prepared to provide construction plans, blueprints, and other documentation on the value of components of their building.

Costs to perform a cost segregation study typically range from $1,500 to $10,000 or higher depending on the availability of construction documentation and the complexity of the building.

We are also seeing a growing number of DST sponsors who provide investors with a cost segregation study on their offered properties.

Simple Cost Segregation Example

For example: You buy an apartment building for $1,000,000. The building is valued at $800,000 and the land is worth $200,000. The land is not depreciable, but the building is.

If you depreciate the building over 27.5 years, your depreciation write-off would be $800,000/27.5 or about $29,090 per year.

Let’s presume that the investment generates $40,000 of annual income. The depreciation deduction will reduce your taxable income from $40,000 to just $10,910 ($40,000 less $29,090).

Now let’s see how cost segregation can potentially further benefit you.

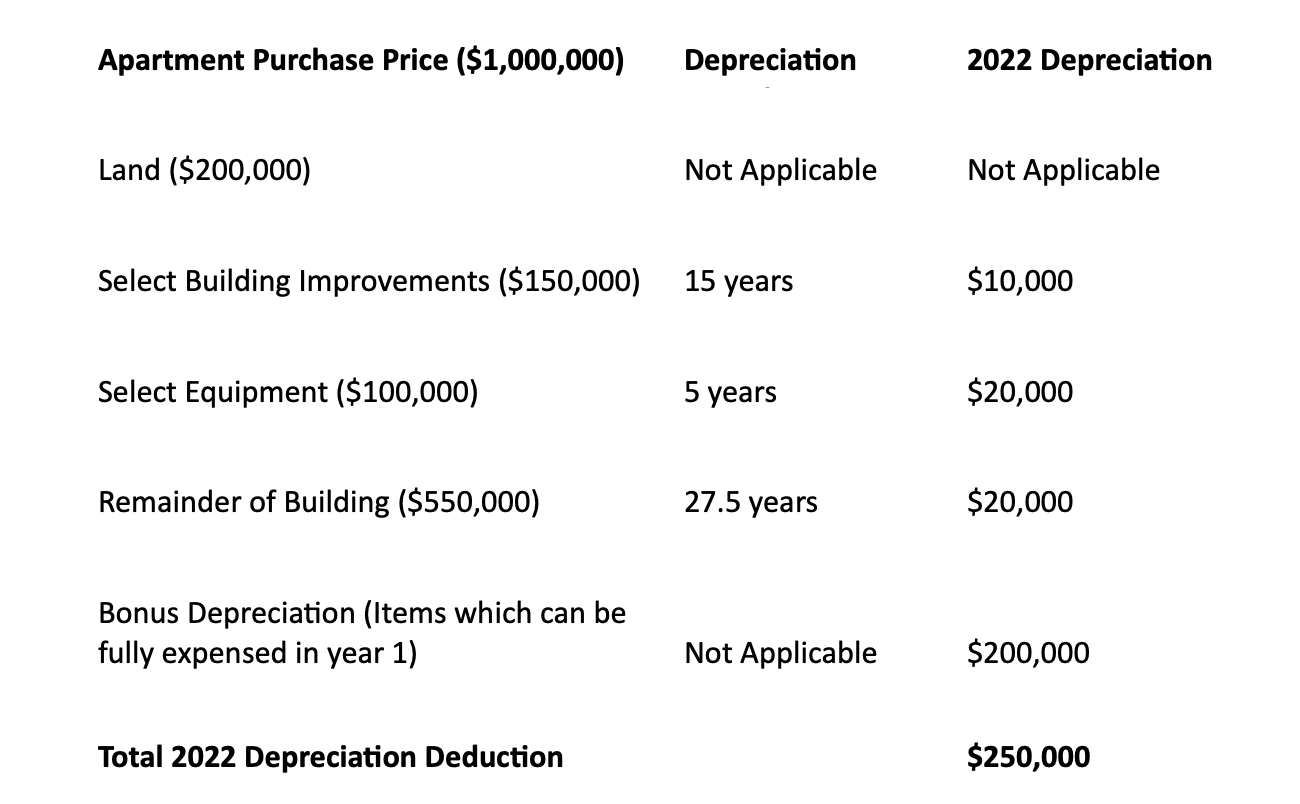

Through completing a cost segregation analysis of your property, you discover that you can reclassify depreciable components of your building as follows:

By utilizing cost segregation and taking advantage of Bonus Depreciation, you have increased your first-year depreciation deduction from $29,090 to $250,000!

While you can only take advantage of a portion of this larger depreciation deduction to reduce your annual taxable income from $40,000 to zero and not pay any taxes, you can carry the excess unused depreciation into future years.

Potential Negative Consequences

There are several trade-offs and consequences that should be considered to determine if cost segregation may be a suitable option for you.

- For many investors, the added effort, time, and cost that is required to achieve improved depreciation deductions may not be worth the results.

- The investor may not be able to find a knowledgeable tax advisor who will represent them if questions arise from tax authorities.

- If the investor sells the property and chooses to take some or all of proceeds rather than completing another full 1031 exchange, depreciation recapture taxes ranging to 35% could be triggered and largely wipe out the benefits.

Conclusion

While we see a growing number of our more sophisticated clients utilizing cost segregation to increase their after-tax income, for most investors, simple straight-line deprecation may be sufficient to yield acceptable after tax returns.

For more information on accelerated tax deferral techniques and for referrals to knowledgeable real estate tax advisors, please contact us!

Have you downloaded our ebook?

Your Comments :