Recently, Keith Lampi, President and Chief Operating Officer of Inland Private Capital wrote an article published by Real Assets Adviser. In it, he provides insight on the Delaware Statutory Trust (DST) structure and its benefits in conjunction with a 1031 Exchange. We would like to thank Keith for allowing us to share this article with our readers.

Keith writes:

Section 1031 of the Internal Revenue Code provides an effective strategy for deferring capital gains tax that may arise from the sale of a business or investment real estate property. By exchanging the real property for like-kind real estate, real property owners may defer taxes and use the proceeds to purchase replacement properties.

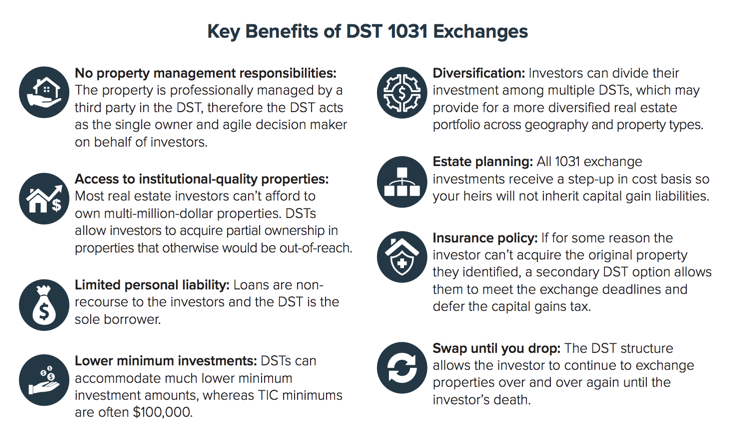

Utilizing Delaware Statutory Trusts (DSTs) in conjunction with 1031 exchanges is an attractive option for investors that can provide many benefits. A DST is a passive investment vehicle that allows multiple investors to own fractional interests in a single property or

portfolio of properties. Beneficial interests in DSTs, which hold real estate, may qualify as a replacement property as part of an investor’s 1031 exchange transaction. Prior to DSTs, Tenant-in-Common (TIC) deals were popular in 1031 exchange transactions. The transition from TIC deals to the more beneficial DST structure began occurring after the real estate recession in 2008.

DIFFERENCES BETWEEN TICS & DSTS

The main differences between TIC programs and DSTs are management and control advantages. The DST structure places all the decision-making into the hands of an experienced sponsor-affiliated trustee, taking it out of the hands of investors. In TIC deals, in contrast, the IRS requires that certain fundamental decisions — such as a sale or refinancing of the property or entering into leases or management agreements — be made unanimously by investors. Simply put, in times of crisis, DSTs are more agile decision-makers. DSTs also provide structural simplicity, as investors only need to execute one agreement – the trust agreement for the DST. The DST owns 100 percent of the fee interest in its real estate so, unlike a TIC program, a lender only needs to make one loan to one borrower.

INVESTOR BENEFITS

In addition to being passive real estate owners, investors who participate in DST offerings may also benefit from lower costs. In a DST program, investors do not incur annual costs of maintenance and qualification of a special purpose limited liability company (LLC) to hold their real estate interest. Moreover, DST investors are not required to execute lender guarantees or indemnities, given their purely passive relationship to the real estate. Furthermore, investors also benefit by the enhanced scalability and diversification that DST programs can achieve. Since the IRS limits the number of investors in any single TIC program to 35, they are generally limited to mid-size or smaller properties (less than $25 million total value) and require large minimum investment amounts. DSTs, however, are not subject to an investor limit under tax law and generally can have up to 2,000 investors if offered in a private placement context. Therefore, DSTs can own properties with an aggregate value much larger than any TIC deal, while simultaneously accommodating much smaller minimum investment amounts, which ultimately allows investors to diversify their investments across multiple DST programs.

Your Comments :