At the beginning of every new year, we encourage all our clients to review their current retirement plans to determine if they still meet their objectives. A common complaint that we hear is that yields on invested funds are often not sufficient to meet planned retirement goals.

If you reach a similar conclusion after reviewing your accounts, you may consider modifying fund allocations to better performing assets and opening a self-directed IRA to provide additional flexibility to make investments that are generally not offered in traditional retirement accounts.

Before discussing the pros and cons of self-directed IRAs, let’s first look at several common retirement plans.

401(k)

The 401(k) plan is the most popular retirement plan for employees. It provides employees an opportunity to divert a portion of their pre-tax income into select investments that grow tax-free until those funds are withdrawn. If the funds are withdrawn before the age of 59½, a tax penalty will be assessed. Funds withdrawn after age 59½ are subject to ordinary income tax rates. Withdrawals currently must begin at age 73.

Many employers will match at least a portion of funds that the employee chooses to put into this plan – essentially providing “free” money - thereby making this plan especially attractive when matching contributions are offered.

The employee contribution cap for 401(k) plans in 2024 is $23,000, while the combined employer and employee contribution cap is $69,000. If you are 50 years of age or older, you can increase your employee contribution limit to $30,500 by receiving an extra $7,500 in catch-up contributions.[1]

In addition to contribution and withdrawal limitations, the types of investments available are generally limited to specified stocks, bonds, and cash offered in the employer’s plan.

Traditional Individual Retirement Arrangement (IRA)

The modern IRA was first introduced in 1974 as an alternative retirement savings option for individuals who did not have pensions.

Traditional IRAs are tax-favored savings accounts that are primarily started and maintained by individuals. If you don't have access to an employer's 401(k), a standard IRA may be an attractive option because almost anybody with taxable income can contribute to one.

IRA vs 401(k)

There are many similarities between an IRA and a 401(k).

The primary distinction between the two types of accounts is that an individual can open an IRA with a brokerage firm, while a 401(k) is an employer-sponsored plan. Instead of selecting from a limited menu of investment options that the employer selected for its 401(k) plans, holders of IRA accounts can choose from a wider range of investments that the broker offers.

The maximum contributions to an IRA are significantly less than to a 401(k). You can only make contributions to an IRA in 2024 of up to $7,000, or $8,000 if you're 50 years of age or older. However, you can fund a 401(k) with up to $23,000 in contributions, or $30,500 if you're over 50 – and up to $69,000 if your employer matches contributions.

The rules for withdrawals are similar for traditional IRAs and 401(k)s. Unless specific limitations apply, you will be penalized financially in both scenarios if you make distributions before the age of 59½. Additionally, investors must begin taking Required Minimum Distributions (RMDs) by the age of 73 for both accounts.

Converting your 401(k) to an IRA

Conversion of a 401(k) to an IRA can provide individuals with a wider range of investing alternatives. You have the option to open an IRA with any broker that provides the accounts, rather than being restricted to the 401(k) administrator that your company selected. Not only can you select any investments available through your broker, but you can also select those that are not on your employer's menu of alternatives.

You will still be subject to age-related restrictions, such as having to start drawing required minimum distributions (RMDs) at age 73 and paying a penalty for withdrawals made before age 59½, even if you move your investments from your 401(k) to a regular IRA.

Plus, having all of your retirement assets in one location rather than dispersed among multiple 401(k) plans may make it simpler to manage them if you've changed jobs.

Transfer of Funds from a 401(k) to an IRA

You can transfer money from your 401(k) into an IRA in one of two ways.

The first and simplest way is to roll over your 401(k) savings directly. Your 401(k) funds are sent directly between the custodians of the 401(k) and the IRA. You might also directly obtain a check payable to your new account (not you) from the 401(k) administrator. When properly executed, no taxes or penalties are withheld.

The second kind of rollover is indirect; in this scenario, your 401(k) provider directly sends you a check. Following that, you will have 60 days to deposit the check with the custodian of your IRA. However, there are certain disadvantages to this route.

- Funds remaining in the 401(k) may be subject to taxes — and possibly subject to penalties

- The 401(k) employer is required to withhold 20% for taxes when an indirect rollover is carried out

The good news is that if you deposit the full amount into your IRA within 60 days, you will get that 20% back when you receive your tax return.

Roth IRA

An IRA that you fund with after-tax money is called a Roth IRA. Your contributions and gains grow tax-free, and you can take money from the account tax-free and penalty-free after five years after opening it and reaching the age of 59½. However, there are no tax benefits for the current year in which you deposit funds.

The main distinction between a Roth IRA and a standard IRA is when you receive the tax benefits. When you make contributions to a typical IRA, there is no income tax due; nevertheless, taxes are due when funds are withdrawn. The situation is completely reversed with a Roth IRA: contributions are taxed, but withdrawals are tax-free when you reach retirement, meaning that every dollar you put into the account puts money in your pocket.

Is a regular or Roth IRA the better option?[2]

Experts state that one important consideration is whether you anticipate paying more or less in taxes when you retire. Because their income is smaller in retirement, many people anticipate paying less in taxes. If so, a traditional IRA may be a better option for you; if not, a Roth IRA may result in lower overall income tax payments.

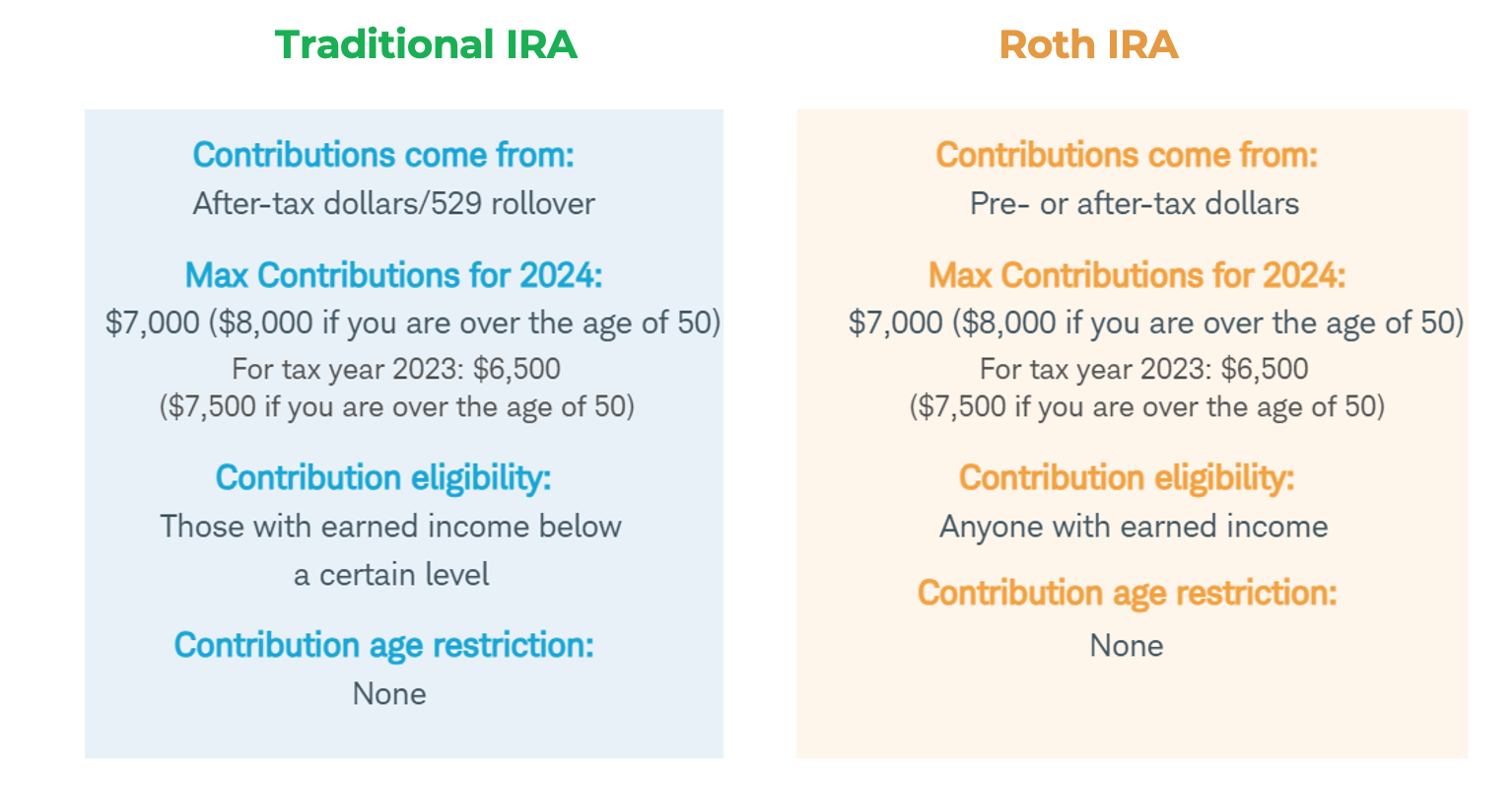

Roth IRAs have more limited contribution limits than traditional IRAs:

The Self-Directed IRA

One type of individual retirement account that allows you greater control and flexibility over the investments in the account is a Self-Directed IRA. You can invest in a wider variety of assets with a self-directed IRA than just the standard alternatives like stocks, bonds, and mutual funds.

The self-directed Roth IRA is like the Roth IRA described above – but provides a wider range of investment options using after tax dollars that can potentially grow and be withdrawn tax free.

Self-directed IRAs are subject to the same tax laws and regulations as traditional IRAs. The contribution caps for 2023 remain the same at $6,500, or $7,500 for individuals 50 years of age or above. These caps are set at $7,000 for 2024 and $8,000 for those 50 years of age and over. Like with a standard IRA, contributions to a Roth IRA are made after taxes; nevertheless, they are still tax deductible. Profits increase tax-deferred, or in a Roth account, tax-free.

An increased selection of investment options is what distinguishes self-directed IRAs. Alternative assets include real estate, privates REITs, precious metals, private companies, private loan contracts, and cryptocurrency investments, among others.

Opening a Self-Directed IRA

All IRAs must be held in trust by brokerage firms. The majority of well-known brokerage firms however do not provide self-directed IRA options.

Individuals seeking to open a self-directed IRA will need to seek out financial organizations that specialize in them, such as some banks and trust companies who serve as custodians for these accounts. You'll need to compare them based on costs, convenience and the types of assets that they agree to manage. because they may not all agree to manage the same kinds of assets.

Many of our clients will first seek out desired investments that can be made with self-directed funds - and then obtain referrals from our firm or from the investment sponsors to open a self-directed IRA account that has approved the specific investment. Individuals can establish more than one self-directed IRA account as needed.

Risks of Self-Directed IRAs

Self-directed IRAs allow individuals the greatest amount of flexibility in selecting investment options – including those that may have greater risks than investments offered by well-known brokerage firms. Investors are cautioned to perform adequate due diligence before making investments and be especially skeptical when presented with “too good to be true” investment options.

Conclusion

All retirement plans offer tax breaks to encourage people to save money for their future. There are differences between the different kinds of retirement plans in terms of when income tax is due, contribution caps, and withdrawal guidelines. A self-directed IRA may appeal to individuals who wish to explore a wider range of investment options including real estate. However, due to numerous variables in each plan, it's crucial to speak with a qualified tax or retirement plan expert to determine which plans best fit your situation.

For more information on retirement plans including real estate investment options, please contact us at 408 392-8822 via email at info@fgg1031.com.

Your Comments :