Add another challenge to the far-reaching impacts of the COVID-19 pandemic – broad moratoriums being implemented by counties, cities and municipalities across California and other states, protecting tenants from eviction due to inability to make rent payments.

As the number of U.S. workers filing for unemployment crested 30 million, there would clearly be millions of renters facing the very real prospect of not being able to pay their rent. Legislators anticipated this looming disaster and moved quickly to layout new rules that would provide tenants relief.On March 16, 2020, California Governor Gavin Newsom issued an executive order giving local governments in the state the authority to stop evictions for renters who are able to substantiate their inability to make rent payments due to a loss of or reduced income from the economic impacts of the virus.

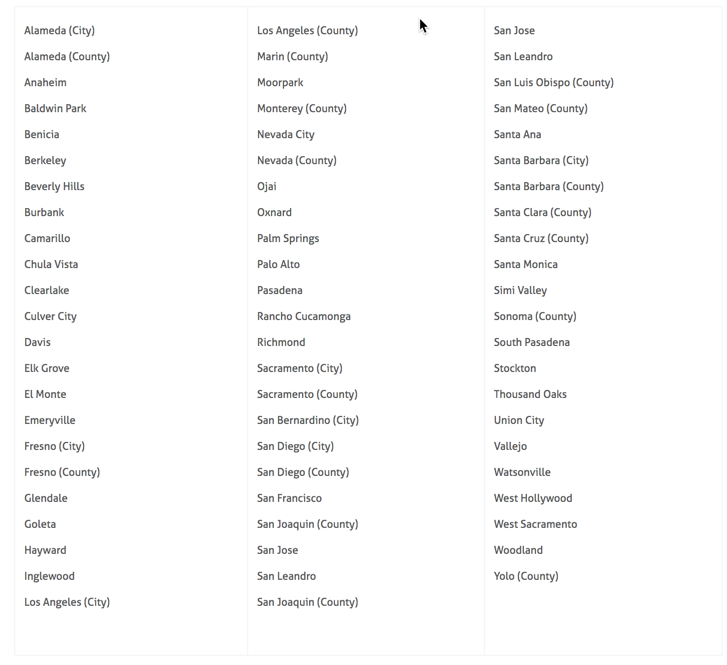

By March 30, the following local governments had adopted COVID-19 eviction restrictions*:

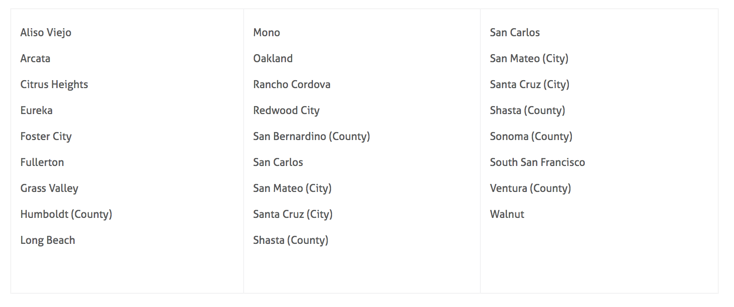

And by the same March 30th date, the following local governments were considering COVID-19 eviction restrictions*:

On April 6th, the Judicial Council of California voted to go even further than the Governor’s moratorium by suspending the ability of courts to issue eviction notices for up to 150 days unless the courts find a health or safety reason.

Guidelines

While local governments will have the ability to define their own rules related to eviction protections which can be even more restrictive than state actions, there are a few guidelines which will apply universally. First, the order does not relieve tenants from their responsibilities to pay rent, nor does it prohibit landlords’ right to recover rent that is due.

Questions arise, however, around the timing of when past due rent must be paid. Once the moratorium is removed, it is generally understood that tenants will have ‘a period’ to pay overdue rent. That time frame can be defined by each local government. The city of Santa Monica identified the repayment period as six months and other jurisdictions may follow a similar schedule. The Governor’s order also prohibits landlords from collecting a late fee on unpaid rent.

Actions for Landlords

Obviously, this moratorium places a significant burden on landlords who either rely on rental income for their own livelihood or have loan obligations that need to be met on their investment property, or both. So, while financial relief, even if only temporary, has been afforded tenants, landlords have not been extended a similar lifeline.

There are steps that landlords can take now, however, that may help them address what is likely to be a painful shortfall in rental income. Many experts are suggesting landlords may benefit by proactively engaging with renters and discussing their specific situations, and then considering creative ways to help overcome the unpaid rent dilemma. A few ideas include:

-

Reduce or defer rent for a defined period and adjust the repayment schedule to be amortized over the remaining term of the lease

-

Apply the tenant’s security deposit towards rent (if available)

-

Reduce or defer rent for a defined period, but add that time back into the end of the lease

Of course, these are not remedying the loss of current income to landlords. And many are suggesting that even after the moratoriums end, landlords should brace for an extended “recapture” period. Few would be surprised if the economic recovery from this COVID-19 induced recession takes a long time, which will impact tenants’ ability to repay back rent as the order requires. At that point, landlords may be forced to begin eviction proceedings, but even that could prove to be laborious as understaffed and overburdened courts work through their backlog of cases.

For these reasons we recommend that landlords contact an experienced real estate attorney to discuss what actions they should be taking today to protect their rights during this current moratorium period and after it is lifted. As a starting point, it is always wise to document and save copies of all communications landlords have with tenants including letters requesting rent, tenant notifications of inability to pay due to COVID-19 and any communications once the ordinances are lifted.

For more information or for referrals to legal advisors, please feel free to contact us at info@firstguardiangroup.com.

Interested in learning more about California’s latest rent control law?

Download our latest eBook, California's AB 1482 Rent Control Law & Investment Options for Sellers NOW!

Your Comments :