In our initial discussions with investors who are planning to sell their first rental properties, it is common to encounter misunderstandings about the potential tax consequences. While all real estate investors understand that taxes will be owed on any increases in property value that occurred over the holding period of the investment, several other tax categories are often overlooked. Before looking at tax consequences, let’s first look at how gains are calculated.

How to Calculate Taxable Gain?

When selling investment real estate, the calculation of taxable gain is more complex than just determining the difference between the purchase price and selling price. This is because US tax laws allow investors to make adjustments to the purchase price or “basis” of the property over time. Investors are allowed to reduce the basis of their rental property by depreciating or reducing the value of the building portion of their investment over time.

For example, current tax guidelines allow residential property owners to decrease the purchase value of the building portion (not the land) over 27.5 years.1 The basis of the property can also be increased through making investments in the property that improve its value such as adding a second story.

The taxable gain is then determined by subtracting the adjusted basis of the property from the net sales price.

Potential Tax Consequences

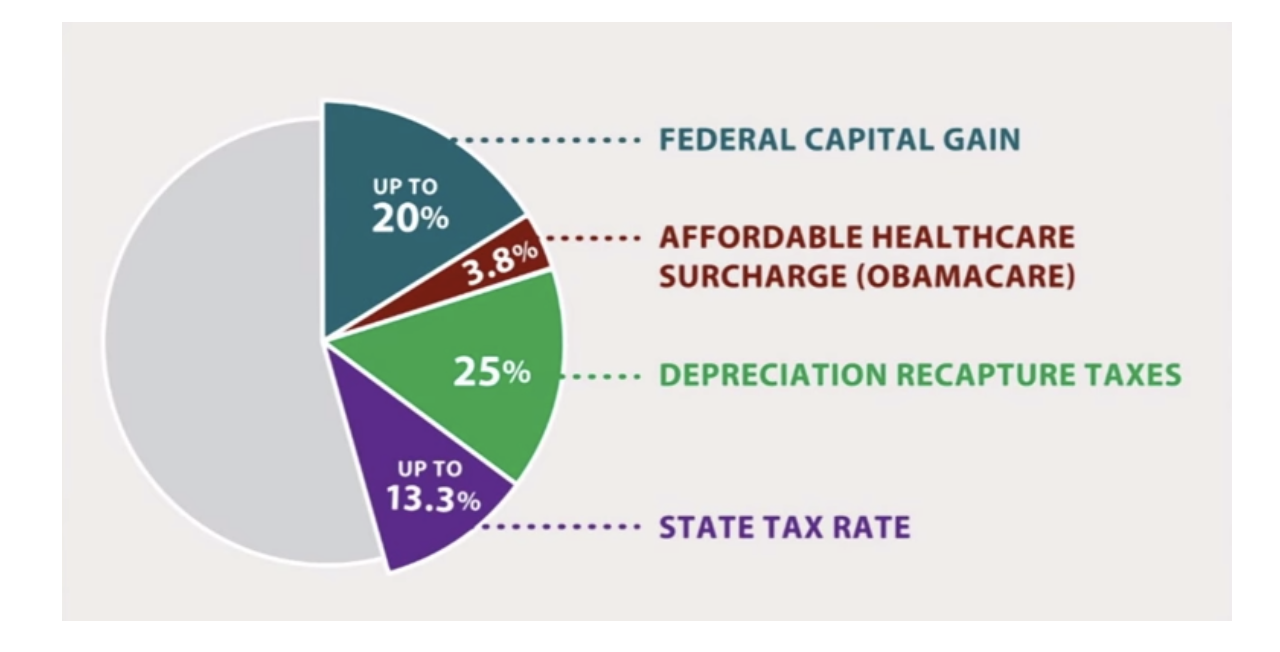

There are generally four categories of potential taxes that may be applicable when selling rental properties. They include the following:

- Federal Capital Gains Taxes

- Affordable Healthcare Surcharge aka Obamacare or Net Investment Tax

- Depreciation Recapture Tax (applies to all past property depreciation)

- State Income Tax

It is common to refer to the combination of these taxes as “Capital Gains” taxes. For California residents, the current rates for each tax category are shown below.

Since these taxes are subject to income thresholds, the blended tax rate California investors pay in California generally ranges from 35% to as high as 42%.2

Swap Until You Drop

Current US tax laws allow investors to potentially defer 100% of the aforementioned taxes up to the time of their passing and permit their survivors to take ownership of their appreciated properties at current market value resulting in the forgiveness of all capital gains taxes.

The deferral of capital gains can come about by 1) simply holding an investment property until the investor passes, or 2) selling and reinvesting sales proceeds into replacement properties utilizing approved tax deferral strategies such as the 1031 exchange, the 721 exchange, or, for a partial deferral, the Opportunity Zone program (among others).

The Bottom Line

Through closely following allowed tax guidelines, it is therefore possible to defer capital gains tax obligations throughout one’s lifetime and then pass on appreciated properties to heirs or a surviving spouse on a step up in value to current value (aka a “step up in basis") with no tax obligations.3

Understanding Your Options

Whether or not you plan to sell your investment property, it is important that you understand your options and select a long term tax deferral strategy that is most suitable for your overall objectives. We encourage you to contact the professionals at FGG1031 | First Guardian Group as well as your personal tax and legal specialists to learn more about retaining the appreciated equity in your real estate investments while minimizing or even eliminating tax consequences.

For more information on this topic, contact us to schedule a consultation.

1 There are other allowed depreciation methods that may be used, and they can vary depending on the type of asset class e.g., apartments versus retail properties.

2 As of the publication date of this blog, Congress is considering increasing the top Federal Capital Gains rate to 39.6% and the Healthcare Surcharge from 3.8% to 5%. While these increases are not likely to be approved, it is another indication that some politicians remain hungry to further increase tax burdens.

3 State laws vary on the treatment of gains for surviving spouses. In community property states such as California, a surviving spouse could receive a full forgiveness of capital gains. In non-community property states such a Florida, a surviving spouse would receive only partial tax forgiveness.

Your Comments :