As an experienced real estate investor, you probably have some familiarity with what is often referred to as the real estate cycle. But it’s always worth refreshing our understanding of how this dynamic force impacts investment properties, especially during periods of market turmoil as some sectors have experienced the past few years. This article re-introduces the cycle and offers a forward view of how different properties may be influenced by it in 2024.

What is the Commercial Real Estate (CRE) Cycle

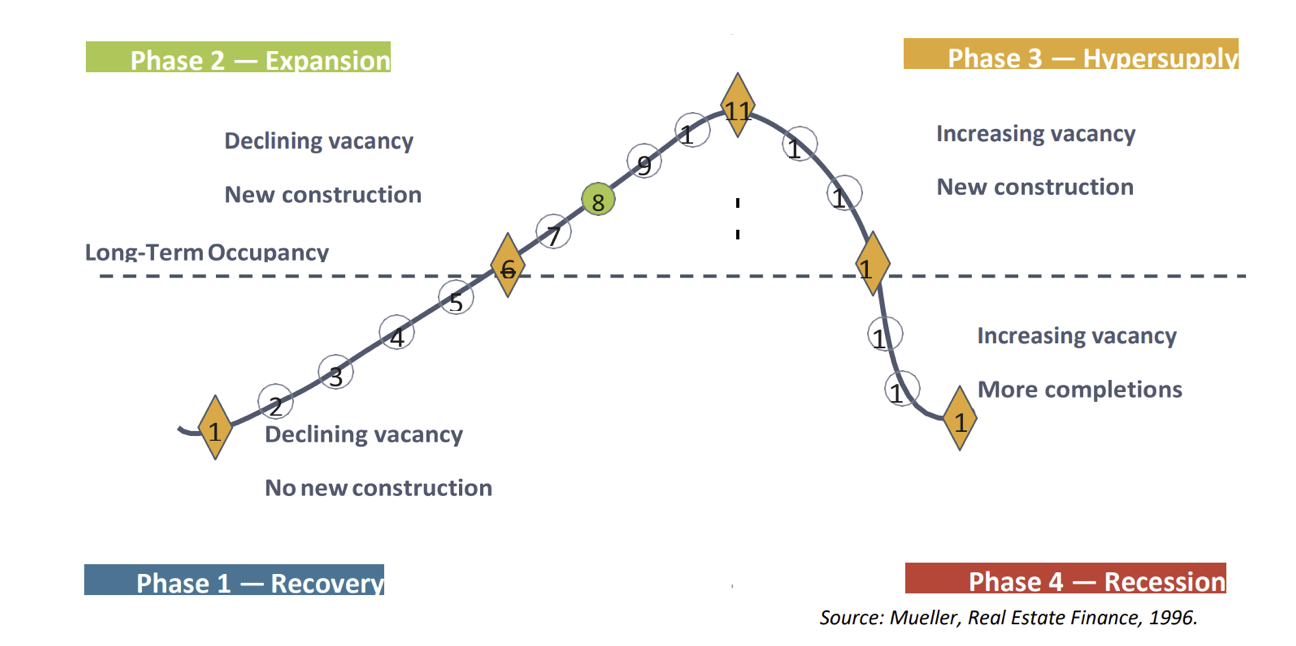

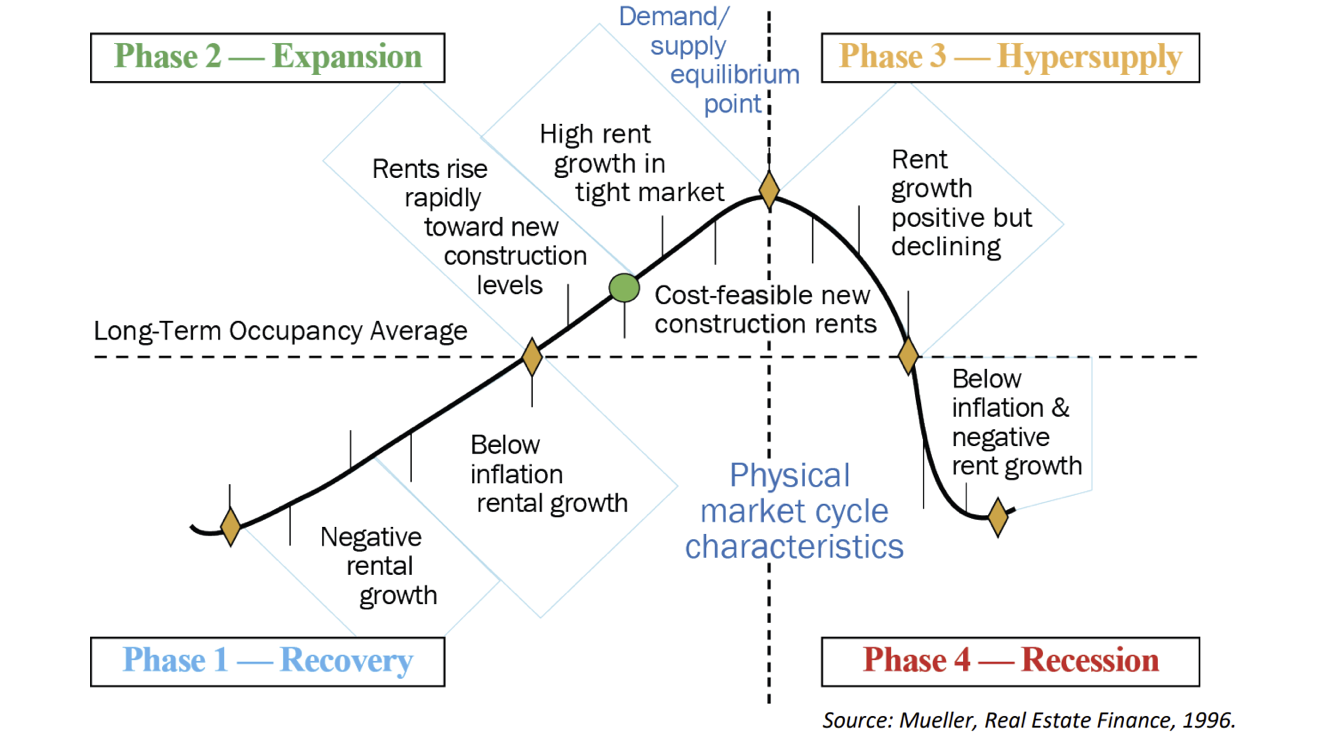

The Commercial Real Estate (CRE) Cycle refers to the pattern of fluctuations seen in the commercial real estate market over time. This cycle mirrors the broader economic cycle, consisting of four main phases: Recovery, Expansion, Hyper Supply, and Recession. Each phase has unique characteristics affecting property demand, rental rates, occupancy levels, and investment strategies. Here's a brief overview of each phase:

Recovery: This phase occurs after a market downturn. During recovery, vacancy rates start to decrease, but rents remain low, and there is minimal new construction. Investors might start to see opportunities for acquisition at lower prices.

Expansion: As the economy strengthens, demand for commercial space increases, leading to lower vacancy rates and higher rents. This environment encourages more development and construction. Investment and development activity peak during this phase, and property values typically rise.

Hyper Supply: When the supply of new constructions exceeds demand, the market enters the hyper supply phase. Vacancy rates begin to increase, and rent growth may slow down or even decline. This phase often serves as a warning sign for the market to slow down development activities.

Recession: This final phase sees a significant increase in vacancy rates and a drop in rental rates. Construction projects may halt, and property values can decline. The recession phase represents the downturn in the market cycle, eventually leading to conditions that resemble the recovery phase as the cycle starts anew.

Understanding the CRE cycle is crucial for investors, developers, and property managers to make informed decisions regarding buying, selling, leasing, and developing properties. Market dynamics can vary significantly based on location, property type, and broader economic conditions, so stakeholders often adjust their strategies according to the specific phase of the cycle.

An Expert View

Glenn R. Mueller, Ph.D., is a well-recognized figure in the field of real estate, particularly known for his work on the commercial real estate cycle. As a professor at the University of Denver's Franklin L. Burns School of Real Estate and Construction Management, Mueller has contributed significantly to the understanding of how commercial real estate markets evolve over time. His research has been instrumental in developing frameworks that investors, developers, and analysts use to evaluate market positions and make informed decisions.

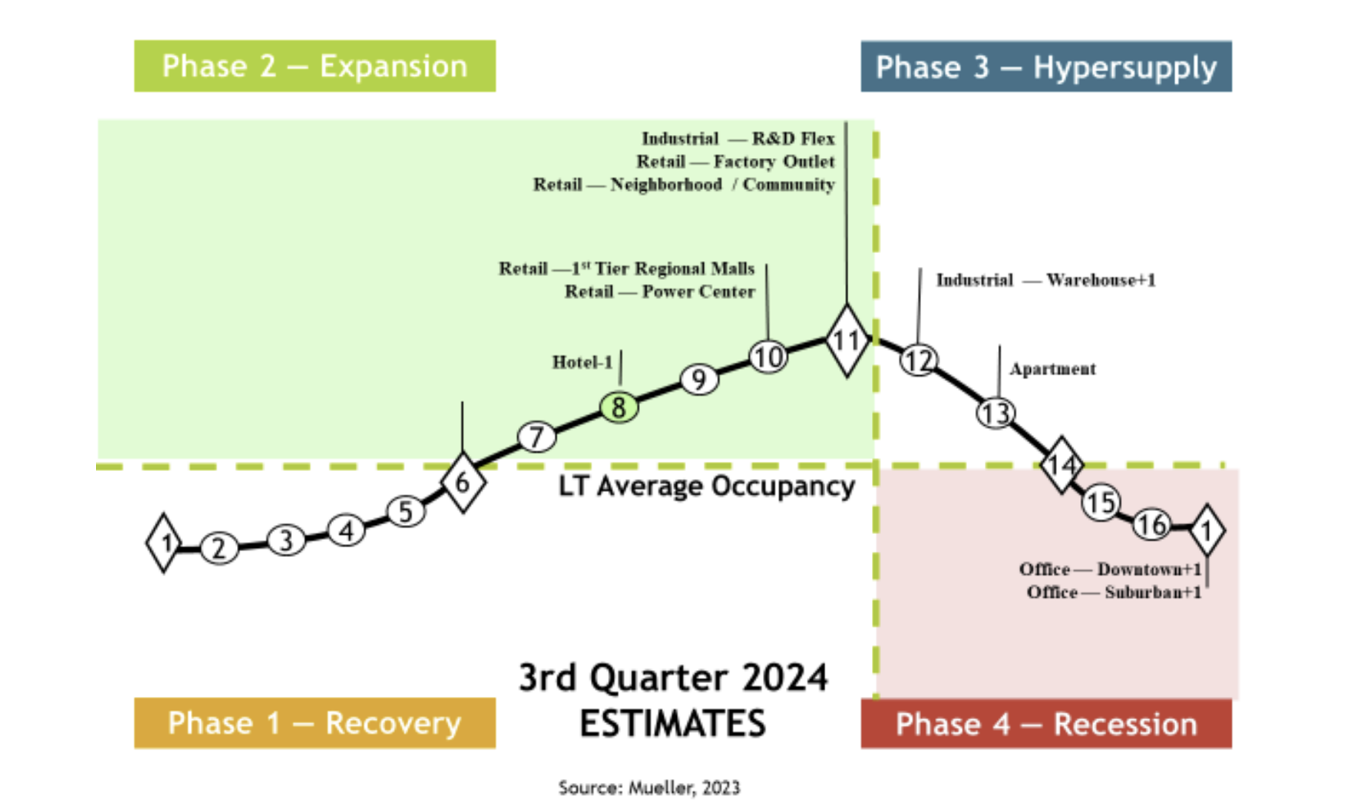

Mueller's work often focuses on the dynamics of supply and demand in real estate markets and how these factors influence various phases of the real estate cycle, including recovery, expansion, hyper-supply, and recession. As you can see here, he has developed models that track these cycles across different property types and markets, providing valuable insights into the timing of investments and strategic management of real estate assets. His research is widely respected and utilized by professionals in the industry for its depth, accuracy, and practical application in investment and portfolio management.

These charts, developed by Dr. Mueller, can help you understand the cycle and the dynamics that influence factors like vacancy, new construction, rent growth and property valuations.

Vacancy and New Construction1

Rent Growth and Property Valuations1

Dr. Mueller’s Forecast1

Based on Glenn R. Mueller's 2024 Real Estate Market Forecast, the outlook for the major property types and cycle positioning through Q3, 2024 is:

Office: Dr. Mueller’s report indicates office occupancies are forecast to decline 0.2% in 3Q24 and be down 1.4% year-over-year. We believe office occupancy rates should continue at their historic bottom and possibly set additional new lows. Low demand and high supply means continued occupancy declines, hampering rent growth. Position: Many major markets in Hypersupply and Recession phases.

Industrial: The national industrial occupancy growth is forecast to decline 0.1% in 3Q24 and be down 1.7% year-over-year. Tenants are expected to slow their inventory accumulation with the slower economy and higher interest rate costs. Rent growth should decelerate in 2024, thus we expect the national average asking rents to increase 0.7% in 3Q24 and be up 3.0% year-over-year. Position: Markets equally split between Expansion and Hypersupply.

Apartment: Apartment occupancies are forecast to decline -0.1% in 3Q24 and be down -0.6% year-over-year. We expect apartment demand to continue being positive but moderate at around 300,000 units. We believe the long-term housing shortage of over 6 million units should allow the apartment markets to move back into the growth phase, possibly in 2025. We forecast the national apartment rental rate to increase 0.4% in 3Q24 and be up 2.1% year-over-year. Position: Most markets in Hypersupply with others split between Expansion and Recession.

Retail: Retail occupancy is forecast to be flat in 3Q24 and flat year-over-year. We expect ALL markets to remain at their peak/equilibrium point on the cycle graph over the next full year. Retailer demand is expected to be positive, but moderate, while supply growth continues to be constrained. We forecast retail asking rental rates to increase 0.5% in 3Q24 and be up 2.3% year-over-year. Position: ALL markets in the Expansion phase.

Hotel: Hotel occupancies are forecast to be down 0.2% in 3Q24 and down 0.6% year-over-year. The forecast economic slowdown is driving the lower demand forecast as recreational, conference and business travel slows with higher costs and a more conservative approach to travel spending in slower times. We expect national average Revenue Per Available Room (RevPAR) growth to be up 1.0% for 3Q24 and up 4.0% year-over-year. Position: Markets split between Recovery and Expansion.

National Property Type Cycle Forecast1

Summary

We hope this review of the Commercial Real Estate Market Cycle has proven helpful in understanding where certain asset classes will likely reside this year. More importantly, when considering real estate investments, this should serve as a reminder how dynamic the real estate market is and how property sectors perform very differently throughout the cycle.

Please contact FGG10131 | First Guardian Group for more information. You can also schedule a call directly with Paul Getty here.

Your Comments :