During periods of market volatility such as we are currently experiencing, prudent investors tend to increase cash holdings to provide a safety margin against sudden negative events and to also take greater advantage of potential short term investment options that may accompany market corrections.

In this blog post we would like to provide our readers with information on typical short-term cash options that we see our clients utilizing when managing their personal finances.

Rates quoted are based on market conditions as of October 2023 – so please check on sources noted in the footnotes in this blog to see current rates.

Savings Accounts

The first place that most people consider when looking to park idle cash is a conventional savings account such as you would find at a traditional bank or credit union. Funds placed with a bank that is insured by the Federal Deposit and Insurance Corporation (FDIC) are generally protected up to $250,000 per depositor. Funds are easily accessible through ATMs which makes them very convenient. However, the current annual percentage yield (APY) on a traditional savings accounts is only 0.58% - which is far lower than what most people would like to receive.

Higher yielding savings accounts are offered by many online banks who provide returns currently ranging to about 5.5%. Funds are generally insured by the FDIC to $250,000. Most on-line banks do not offer ATM access – so accessing funds can be less convenient.

Yields on savings accounts can fluctuate based on market conditions.

Interest income from savings accounts is taxable at Federal, state, and local levels.

Certificates of Deposit (CDs)

CDs are fixed-income investments issued by banks that pay a specific interest rate for a specified period. CDs are generally insured to $250,000 at financial institutions that are FDIC members. Current rates range to about 5.6%.

CDs may be preferred over high yielding savings accounts since they allow investors to lock-in rates for a set period while yields on savings accounts can vary over time. Early cash withdrawals may be made from CDs – however there may be penalties which would reduce the overall yield.

Income from CDs from CDs is paid periodically e.g., daily, monthly quarterly, etc. and is taxable at Federal, state, and local levels.

Money Market Account

Money market accounts are similar to high yield savings accounts and can provide comparable yields to 5%+. Access to funds is generally easier with money market accounts than with high yield savings accounts since many institutions that offer them have physical branches and ATMs.

Money market accounts are generally insured to $250,000 at financial institutions that are FDIC members

Like savings accounts, yields are variable, and income is taxed at Federal, state, and local levels.

Money Market Funds

Not to be confused with a money market account, money market funds are mutual funds that generally invest funds in corporate, municipal, and treasure securities.

The interest rates are variable, and many are currently paying yields of 5% and higher.

Unlike most savings accounts, money market funds are not insured by the FDIC. Also, it may take several days to access funds – so liquidity is generally less than with savings accounts.

Money market funds can be opened through brokerage and investment firms such as Schwab, Fidelity, Vanguard, and others.

Treasury Bills (T-bills)

Treasury bills are short-term securities that have a maturity period of less than one year. They are considered to be less risky than FDIC insured accounts since they are issued and fully backed by the US government. They can be purchased in relatively small increments e.g., $100 and income is subject to Federal taxes but exempt from state and local taxes

T-bills have an assigned a specific face value, e.g., $1,000, $5,000 or $10,000, but are purchased at a lower price than the face value called the discount rate. During the holding period, no interest is paid, however, upon maturity, the investor receives the full-face value of the bill. Investors also have the option to redeem T-bills before the maturity date.

T-bills currently provide relatively attractive returns as compared to other short term investment options. For example, the current yield on a 1-month T-bill is 5.58%. Given that the related income is not subject to state and local taxes, the after-tax return for T-bills may be higher than returns from other forms of short-term investments covered in this blog.

T-Bills versus Treasury Bonds and Notes

Treasury bonds and treasure notes are similar to T-bills but have longer maturities. Treasury bonds mature in 20 to 30 years and treasury notes typically mature in 2 to 10 years. Due to its popularity, the 10-year treasury note is often quoted in financial news outlets and is the benchmark that is used to assist in setting real estate mortgage rates.

Interest payments for both bonds and notes are generally paid every 6 months.

Protecting Your Bank Deposits

The recent failures of First Republic Bank, Silicon Valley Bank and others have caused many of our clients to seek strategies to better protect their savings.

In a blog post that we published earlier this year, we shared tips that clients may consider to further protect their bank deposits.

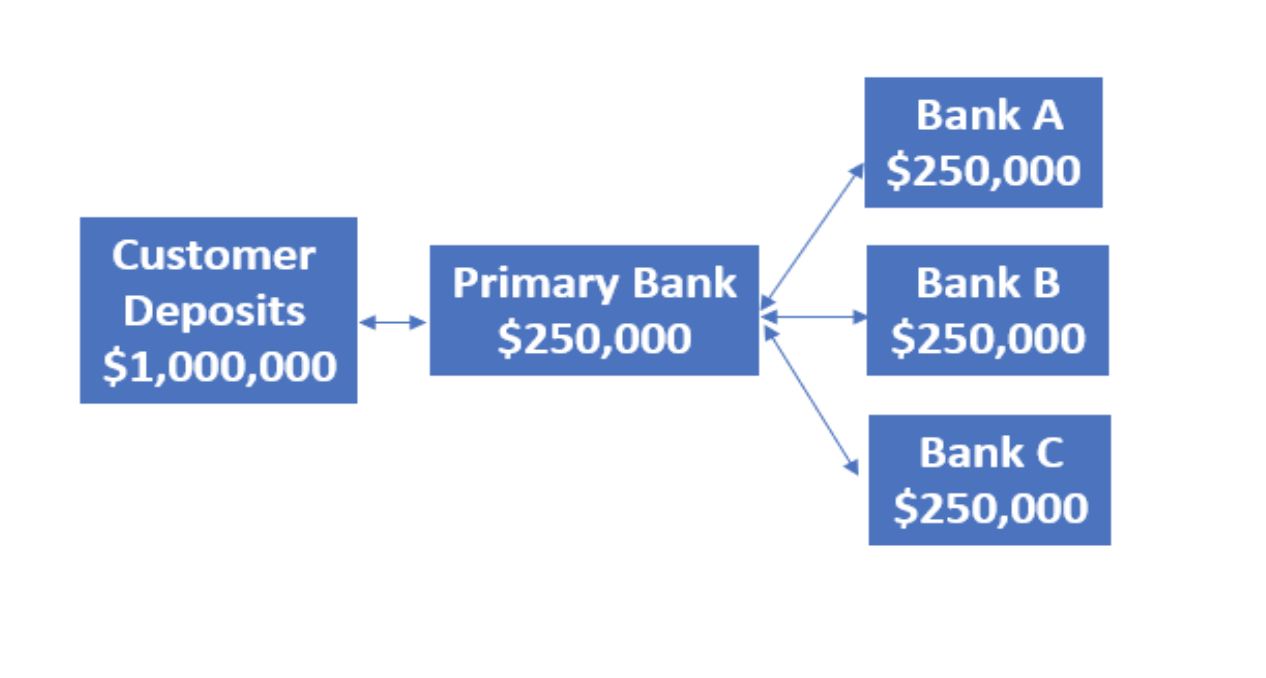

Among the suggestions in the blog that received favorable feedback from readers was to explore options to open an Insured Cash Sweep Account (ICS). This option can increase the typical FDIC coverage of $250,000 per depositor to much higher amounts and also provide a higher rate of interest than are found in a typical savings bank.

To recap the basic concept, deposits greater than $250,000 are automatically placed or swept into multiple participating banks daily thereby compounding FDIC insurance coverage - see below.

If you have concerns about the safety of larger bank deposits, we suggest you first contact your primary bank to see if they offer an ICS account – or see if they can provide recommendations to you.

Bottomline

The staff at FGG1031/First Guardian Group works hard to give our clients peace of mind by providing appropriate investment options, continuing financial counseling, and, when necessary, referrals to other finance specialists.

In addition to providing information about DSTs, 1031 exchanges, and real estate investments, please feel free to contact us with any other general queries or potential financial choices you may have. If we are unable to provide the answers, we will try our best to direct you to someone who can.

1 https://www.bankrate.com/banking/savings/average-savings-interest-rates/

2 https://www.investopedia.com/best-high-yield-savings-accounts-4770633

3 https://www.bankrate.com/banking/cds/cd-rates/

4 https://www.bankrate.com/banking/money-market/rates/

5 https://money.usnews.com/investing/articles/best-money-market-funds-for-2023

Your Comments :