We had previously published a blog on the top questions we get asked regarding 1031 exchanges here.

In this blog post, we will cover the 10 most common misconceptions about 1031 exchanges that we receive from investors who are completing their first exchange.

Misconception #1: When Selling a Single-Family Rental, I Need to Acquire Another Single-Family Rental

Many first-time exchangers interpret the requirement that replacement properties be “like-kind” too literally and believe that their replacement property must be the same kind of real estate that they are selling. Almost all investment real estate is interchangeable with other real estate investment property, so investors may sell a rental home and acquire an apartment, commercial office, retail store, industrial space, raw land – or even oil and water mineral rights which are also considered to be a form of investment real estate. The types of the properties are not required to match. Instead, you can exchange real estate for almost any other real estate in the United States if it is used productively in a trade or business or for investment purposes.

Investors may also sell one property and purchase multiple properties or vice versa.

Misconception #2 - Investors must invest all the net proceeds from the sale of investment property to purchase replacement property and cannot use proceeds for other purposes.

If investors are unable to invest all the exchange proceeds or desire to pull funds out of the exchange, they have the option to complete a partial tax deferral. A fully tax-deferred 1031 exchange will occur if the exchanger purchases a replacement property of equal or greater value than the relinquished property, uses all the equity from the sale to fund the purchase, and secures financing on the replacement property that is equal to or greater than that available on the relinquished property.

In general, an investor will only be subject to capital gains tax on the portion of the proceeds from the sale of the relinquished property that was not used to buy qualifying replacement real estate. This includes investors who wish to purchase replacement real estate of lower value or with less financing or who wish to use a portion of the proceeds for purposes other than purchasing replacement real estate. An investor who exchanges into a property with less financing can invest additional cash from outside of the exchange to make up the difference in financing and avoid tax obligations.

Misconception #3: My replacement property must generate rental income to qualify for a 1031 exchange

The tax code states that an eligible 1031 replacement property “must be used in a trade or business or be held for investment.” There is no requirement that the replacement property generate rental income. For example, an investor can exchange into raw land which may not generate any income with an intent to hold it for appreciation. An important guideline to follow is to be sure to file appropriate tax reports e.g., Form 8824 in the first year following the completion of the exchange along with annual income and expense summaries on a Schedule E. Generally, properties that do not generate income may still have expenses that should be reported in annual tax filings.

Misconception #4: I cannot defer the gain on the sale of personal residence through a 1031 exchange

When selling a personal residence, there are tax obligations on any gain in property value that may have occurred during the ownership period. However, property owners are permitted to convert their personal residence into a qualifying rental property by moving out and renting their home for minimum of two years prior to completing a 1031 exchange. If the personal residence is properly converted to a rental property, the gain on the sale can be fully exchanged into qualifying 1031 replacement properties and taxes can be deferred and potentially avoided altogether upon the passing of a principal owner.

Misconception #5: When an investment property is owned by a partnership or corporation and then sold, participants may complete individual 1031 exchanges with their pro rata sales proceeds.

We are often approached by an investor whose investment property is held in the name of a Limited Liability Company (LLC) or other partnership or corporate structure and who wishes to complete a 1031 exchange with their portion of sales proceeds from a planned sale of the property. One of the strictly enforced 1031 exchange rules in these ownership structures requires that there be “title continuity” between the sold property and all replacement properties in an exchange. For example, if the property to be sold is held in the title of “ABC LLC,” all replacement properties in the exchange must be purchased and held by ABC LLC as the owner. Individual members are not allowed to go their separate ways in exchanges of properties held in these ownership structures and all members must move forward in lock step with each other.

Two group ownership structures, Tenant in Common or Delaware Statutory Trust do however allow individuals to go their separate ways at time of sale. In these structures, each participant can choose to invest in separate replacement properties – or withdraw cash from the sale at their own choosing without being tied to the actions of other co-investors.

It is also possible to convert more restrictive ownership structures such as LLCs into a Tenant in Common structure to provide greater reinvestment flexibility to participants at time of sale.

Misconception #6 – The 45-day identification deadline is a guideline, and I can backdate or swap out an identified replacement property after the deadline has passed.

1031 exchange rules are very strict regarding adhering to permitted timelines to identify and acquire replacement properties. With rare exceptions, all potential replacement properties must be properly identified in writing by no later than midnight of the 45-day following the sale date of the relinquished investment property. This deadline applies even if the 45th day days falls on a weekend or a holiday.

Back-dating, swapping, altering, or amending information on potential replacement properties in order to save an exchange are classified as tax fraud and both investors and qualified intermediaries who engage in these actions can be subject to harsh penalties.

The only exception to 1031 deadlines is if the President of the United States declares a national disaster that impacts either the properties or parties involved in the exchange. If you feel that you may be eligible for an extension due to a natural disaster, please verify details with your qualified intermediary.

Misconception #7 – I can receive any remaining balance in my exchange account whenever I request it.

To complete a 1031 exchange, all net proceeds at time of sale must be transferred by the title company to a 1031 exchange account that was previously opened by the investor with a qualified intermediary firm (aka a QI or accommodator). Any funds that do not go to the QI firm will be subject to taxes.

Once sales proceeds are received by the QI firm, US Treasury rules limits the ability of the QI to promptly return any remaining funds to the investor. For example:

-

Even if the investor decides they do not want to proceed with a 1031 exchange, the exchange funds cannot be released during the 45-day identification period which follows the sale of the investment property. The funds could be refunded to the investor on the 46th day if they don't proceed with the exchange and don't identify a replacement property.

-

If the investor has made any replacement property identifications, the funds cannot be returned until 180-days after the sale of the investment property, even if the investor decides not to close on a replacement property or asks to cancel the exchange. The earliest that these remaining funds can be returned to the investor is on the 181st day following the sale of the investment property.

-

A significant event outside the control of the investor that prevents him/her from acquiring an identified replacement property e.g., fire, rezoning, natural disaster may allow the QI to release the funds prior to the 181st day.

For these reasons, if an investor desires to NOT reinvest all their sales proceeds in a 1031 exchange, it is advised that they provide written instructions to the escrow company handling the sale of their investment property to send the desired amount of sale proceeds directly to them and not to the qualified intermediary firm.

Investors should be sure to closely read the language in their exchange agreement when opening an exchange account with a qualified intermediary firm and verify that the terms of the agreement provide sufficient flexibility to meet their objectives.

When interviewing QI firms, be sure to ask “Under what conditions can I receive any uninvested funds that remain in my exchange account?”

Misconception #8 – I must hold an investment property for a minimum of two years before I can complete a 1031 exchange.

In Private Letter Ruling 8429039 issued in 1984, the IRS stated that a holding period of two years would be a "sufficient" period for the property to be considered held for investment. Though private letter rulings do not constitute binding precedent, some tax advisors believe that two years is an adequate holding period, if the investor not only held the property for two years, but also intended to do so for investment purposes.

IRS code makes a distinction between investment properties that are either 1) held with an intent to invest or 2) held with an intent to resell. Investment properties held for investment would generally qualify for a 1031 exchange whereas properties that are purchased with an intent to resell such as flippers would not.

Investors may be able to sell replacement properties held for less than two years if they can provide sufficient proof that they intended to hold the property for investment and not for resell at the time of making the investment.

Holding periods shorter than two years may qualify if the investor can provide documentation verifying their intentions at time of purchase. Examples of potentially persuasive documentation could include written correspondence with third parties familiar with the purchase such as tax advisors, attorneys, realtors, etc.

See this past FGG1031 blog for more information.

Misconception #9 – I do not need to start the 1031 exchange process until my investment property is under contract to sell.

Waiting until the investment property has a sale contract in place before evaluating 1031 exchange options is a common error with many first-time exchangers. Due to this misconception, investors frequently have insufficient time to properly plan their exchange and select a replacement property. The exchange transaction will go more smoothly and have a higher probability of success the earlier the investor weighs choices and talks with knowledgeable 1031 specialists about their objectives.

Before beginning the exchange process and, ideally, before marketing their relinquished property for sale, an investor should discuss the exchange with their tax advisor to determine their potential tax liability if they do not complete a 1031 exchange. If the property is jointly owned with other investors, make sure all stakeholders are aware of potential tax consequences and support planned reinvestment options.

If an investor is advised to consider a 1031 exchange by their tax advisor, they should start evaluating reinvestment options even before they begin marketing their investment property. This helps create more accurate expectations about market conditions and the timeframe to identify and close on potential replacement properties.

Misconception #10 – If I do not complete a 1031 exchange, I am liable to pay only a capital gains tax of 15% or 20%.

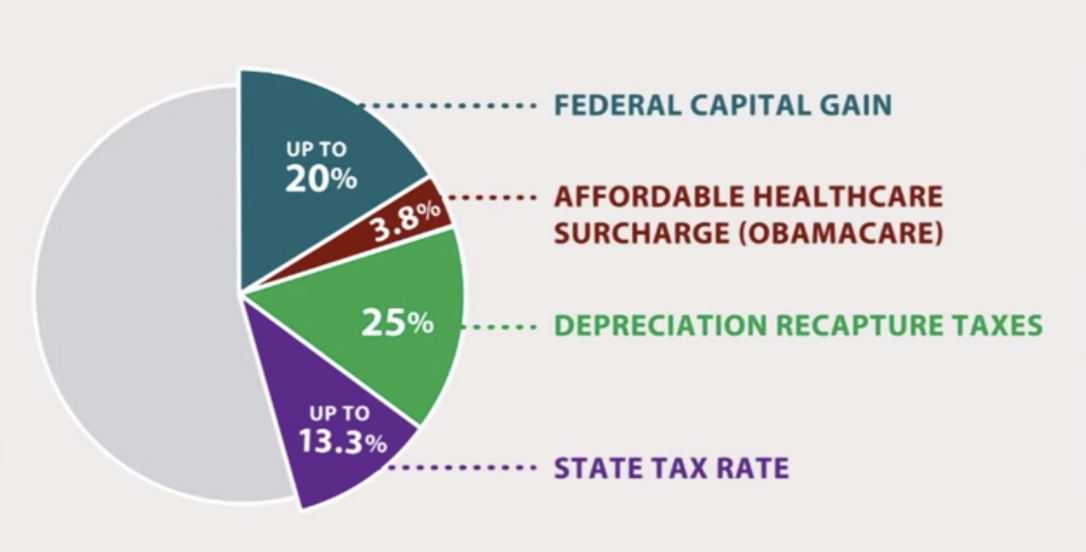

First time exchangers are often surprised to learn that the total tax liability when selling an investment property can range up to 40% or perhaps even higher. This is due to the combined impact of multiple taxes in addition to capital gains taxes – see below.

Note that while these taxes are subject to an investor’s income in the year of the sale, the sale proceeds will add to investor’s annual income and potentially push them to the top marginal tax rates in each category.

An investor may initially be OK with contemplating a total tax obligation of only 15-20% and foregoing a 1031 exchange, but they may become more motivated to explore 1031 options when they discover the fuller extent of their potential tax liability.

Summary

We strongly advise all owners of investment properties to discuss their plans, objectives, and reasons for selling with knowledgeable 1031 professionals before contemplating the sale of their property. In our daily conversations with real estate investors, including many who have previously completed 1031 exchanges, we encounter many misconceptions that, if not addressed, can lead to sub-optimal investment outcomes.

A 1031 exchange may or may not be a good business decision based on many factors. If you are exploring selling an investment property, please contact us so we can help you become more fully informed and hopefully better able to make the right decisions.

2 https://www.exeterco.com/deadlines_for_1031_exchanges

3 https://www.irs.gov/pub/irs-drop/rp-03-39.pdf

4 This chart includes the top marginal income tax rate for California of 13.3%. Investors who reside in other states will be subject to applicable state income taxes which will differ.

Your Comments :