We received several questions in recent weeks about converting a rental property into a personal residence. Related questions most often arise when a real estate investor is considering the sale of a rental property and wishes to reinvest their 1031 exchange proceeds into a replacement rental property that they eventually wish to move into.

In this blog post, we’ll explore how to successfully accomplish such a conversion and address potential tax consequences.

Important Steps to be Followed

Property Selection

Investors who plan a future move into a rental property will likely exercise more care and require more time in the selection of the replacement property than when selecting a property that will remain as an investment property. In many cases, they will identify the replacement property and tie it up before they begin selling their relinquished property. To be certain that the replacement property remains available, they may consider completing a reverse 1031 exchange wherein they work with a Qualified Intermediary who will purchase the property on their behalf and hold it pending the completion of the sale of the relinquished property. 1

Meeting the 1031 Exchange Like-Kind Requirement

Once the exchange is completed and the replacement property is acquired, it is critical to follow these rules to avoid challenges from the tax authorities:

- The investor must develop proof that the property was purchased with an intent that it initially be held for business or investment purposes. This is most easily accomplished by renting the property at a prevailing market rate for a minimum of two tax years and filing annual Schedule E tax returns for the income received.2

- Limited personal use of the property is permitted provided that such usage does not extend beyond either 14 days or 10 percent of the total number of days the property was rented during a 12-month period.

We have heard of cases where investors acquire a replacement property and do make a sincere effort to rent it out of concerns that having a tenant may complicate their move in strategy. If the property remains vacant - perhaps by offering it above market rates, or failing to follow-up on inquiries from potential tenants, red flags are likely to go up if the exchange is audited.

Investors should also avoid documenting their intention to eventually move into the property prior to completing their 1031 exchange. Waiting two years doesn’t cure a written statement of an intention to make it a personal residence. It is best to document a change of circumstances after acquiring the property. For example, a year and a half to two years after the purchase you need to move closer to your parents to take care of them. Or the house you currently own has stairs that you can no longer easily climb, and it makes more sense to move into the rental property than buy a new residence. Tax advisors are not pleased representing a client who has a bunch of emails talking about how they plan to buy rental property and convert it to a residence two years from now.

The property can also be rented to a family member provided that fair-market rent is being paid and reported to the tax authorities.

Having a solid paper trail along with support from a tax advisor is the best way to establish that the intent of the exchange was to initially acquire the property for business for investment use. Once the two-year holding period has been met, the investor can then move into the property.

Conversion of Rental into Personal Residence

The conversion is formally completed when the investor has updated their personal records e.g., driver’s license, bank accounts, credit card statements, voter registration, post office notice, etc. to reflect their new residence address. The converted property is no longer reported on a 1040 Schedule E tax form but on the Schedule A form where you will be reporting property tax and mortgage interest deductions.

Tax Implications

Tax considerations are generally derived from two separate sections of the tax code, IRC Code Section 1031, and IRS Code Section 121.

1031 Exchange Impact

The desired outcome of the 1031 exchange is to fully defer taxes owed upon the sale of an investment property into the future and potentially avoid them altogether if the investor passes and the property is passed onto successors.3

Once the property has been converted into a personal residence, the tax obligations associated with the prior 1031 exchange remain (bad news) but (good news) they will not need to be paid until the replacement property is sold in the future. Also, the capital gain portion of 1031 tax obligations may be partially reduced through taking advantage of additional tax exclusions available under IRS Section 121.

The 121 Tax Exclusion

IRS Section 121 was created in 1997 and allows owners of personal residences to exclude up to $250,000 of gain on the sale of their residence - or up to $500,000 for a married couple who files jointly. To qualify, the homeowner(s) must own and use the home as their primary residence for a total of any 2 of the past 5 years.

In order for rental properties that have been converted to primary residence to qualify for the Section 121 exclusion, they must have been owned by the taxpayer for at least five years.

A partial exclusion may be available if the property is sold in less than two years if there were “unforeseen” circumstances that created a need to sell such as a change of employment, or health matters, among others. The amount of allowed exclusion is pro- rated over the period that the homeowner lived in the property. For example, if the home was a personal residence for 18 months, the allowed exclusion for a married couple would 18 months/24 months or 2/3 times $500,000 or $333,333.

The 121 exclusion only applies to capital gains and cannot be used to offset depreciation recapture or the 3.8% net investment tax (aka Obama Care tax).

Combining a 1031 Exchange with a 121 Exclusion

“I wish to sell a current rental property and complete a 1031 exchange into a rental property that I will convert to my personal residence later. Can I combine the benefits of a 1031 exchange with a 121 exclusion to minimize my overall tax burden?”

Quite possibly – but the savings may not be as great as you think since the 121 exclusion is pro-rated over the combined holding period of the relinquished property and acquired property.

It is best to answer this question by providing a detailed example. Be forewarned that this example is a bit complex and may lead to further questions that are best answered by a qualified tax advisor.

Example4

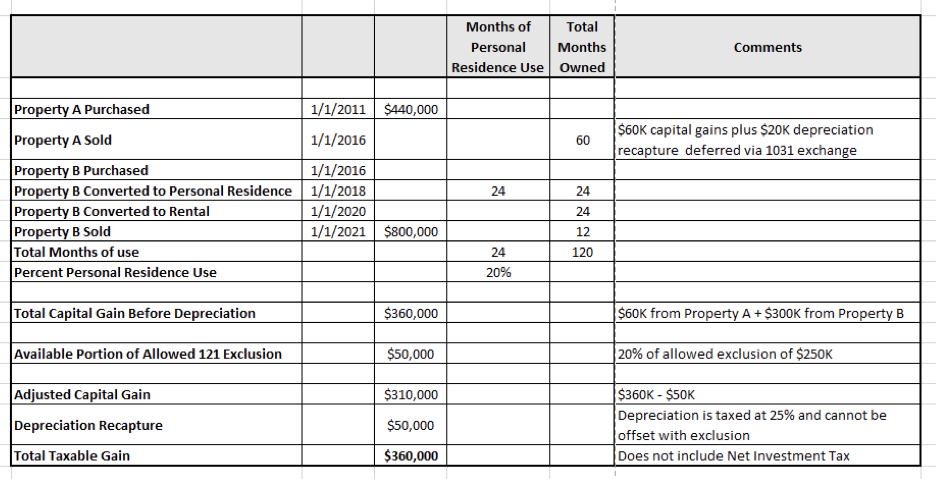

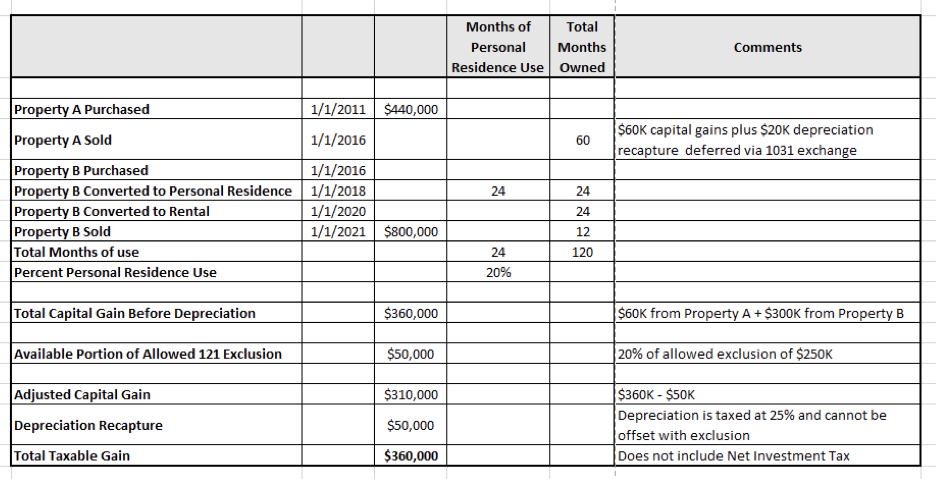

Alex purchased a rental property (“Property A”) on January 1, 2011, for $440,000. He owned it for five years and decided to sell and complete a 1031 exchange to purchase another rental property that he eventually planned to convert to his personal residence. At the time of sale, he was deferring $60,000 in capital gains, and $20,000 in depreciation recapture.

To complete his 1031 exchange, Alex purchased a residential replacement (“Property B”), on January 1, 2016, for $500,000 and rented it for two years. On January 1, 2018, the tenant moved out and Alex moved in and converted it to his personal residence. On January 1, 2020, he moved out and rented it again. He then sold the property for $800,000 on January 1, 2021.

At time of sale, Alex therefore had a $300,000 capital gain on the sale of his primary residence, Property B, and an additional carry-over gain of $60,000 from the sale of rental Property A for total taxable capital gain of $360,000.

Alex also had depreciation recapture of $30,000 on Property B plus carryover depreciation recapture of $20,000 from Property A.

Calculation of the Allowed 121 Exclusion

Alex owned Property A and Property B for a total of 10 years. The allowed 121 exclusion only applies to the portion of when the properties were used as a personal residence. To recap, Property A was rented for 5 years, and Property B was rented for 3 years. Since Alex converted Property B to his personal residence for only 2 years, he would be allowed to only apply 2/10 or 20% of his allowed $250,000 exclusion or $50,000 to reduce his taxable capital gain.

Furthermore the $50,000 reduction would only apply to his capital gain and would not reduce his tax obligations related to deprecation recapture or payment of the net investment tax (3.8%).

See this summary below:

Bottomline

The conversion of a rental property into a personal residence can be an attractive option for investors to consider – especially if they plan to downsize or relocate to a new area. By combining 1031 tax deferral strategies with the allowed 121 exclusion of capital gains on a personal residence, overall tax obligations can be potentially reduced.

Executing these strategies should be undertaken with the assistance of a knowledgeable real estate tax advisor.

Next Steps

To learn more about tax deferral and investment strategies please schedule a meeting with our professionals at First Guardian Group at 866 398-1031 or email us at info@fgg1031.com.

Have you downloaded our ebook?

Your Comments :